Dimensional Fund Advisors LP lessened its holdings in IES Holdings, Inc. (NASDAQ:IESC - Free Report) by 2.2% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 663,935 shares of the technology company's stock after selling 15,020 shares during the quarter. Dimensional Fund Advisors LP owned approximately 3.32% of IES worth $133,431,000 at the end of the most recent reporting period.

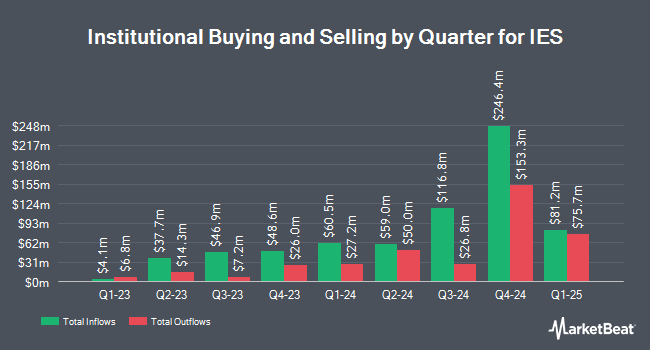

Several other institutional investors also recently modified their holdings of IESC. Vanguard Group Inc. raised its position in shares of IES by 38.9% during the 4th quarter. Vanguard Group Inc. now owns 753,331 shares of the technology company's stock valued at $151,389,000 after acquiring an additional 210,925 shares during the last quarter. Thrivent Financial for Lutherans grew its stake in shares of IES by 140.3% during the fourth quarter. Thrivent Financial for Lutherans now owns 125,500 shares of the technology company's stock worth $25,221,000 after purchasing an additional 73,271 shares during the period. Franklin Resources Inc. increased its holdings in IES by 79.3% in the third quarter. Franklin Resources Inc. now owns 155,426 shares of the technology company's stock valued at $31,026,000 after purchasing an additional 68,750 shares during the last quarter. Invesco Ltd. boosted its holdings in IES by 27.6% during the fourth quarter. Invesco Ltd. now owns 200,799 shares of the technology company's stock worth $40,353,000 after buying an additional 43,449 shares during the last quarter. Finally, LPL Financial LLC grew its position in shares of IES by 588.0% during the 4th quarter. LPL Financial LLC now owns 46,426 shares of the technology company's stock worth $9,330,000 after buying an additional 39,678 shares during the period. Institutional investors and hedge funds own 86.60% of the company's stock.

IES Stock Up 7.6 %

Shares of IESC traded up $15.04 during trading hours on Thursday, reaching $211.72. The stock had a trading volume of 60,865 shares, compared to its average volume of 176,973. The firm has a 50-day moving average of $178.99 and a 200 day moving average of $219.26. The company has a market cap of $4.24 billion, a P/E ratio of 19.76 and a beta of 1.51. IES Holdings, Inc. has a 52 week low of $124.55 and a 52 week high of $320.09.

IES (NASDAQ:IESC - Get Free Report) last issued its quarterly earnings data on Tuesday, February 4th. The technology company reported $2.64 earnings per share (EPS) for the quarter. IES had a return on equity of 35.81% and a net margin of 7.30%.

Analyst Ratings Changes

Separately, StockNews.com cut shares of IES from a "buy" rating to a "hold" rating in a report on Friday, March 14th.

Read Our Latest Analysis on IESC

About IES

(

Free Report)

IES Holdings, Inc engages in the design and installation of integrated electrical and technology systems, and provides infrastructure products and services in the United States. The Communications segment designs, installs, and maintains network infrastructure within data centers for co-location and managed hosting customers; corporate, educational, financial, hospitality, and healthcare buildings; e-commerce distribution centers; and high-tech manufacturing facilities.

See Also

Before you consider IES, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IES wasn't on the list.

While IES currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.