Equities researchers at Deutsche Bank Aktiengesellschaft initiated coverage on shares of Intel (NASDAQ:INTC - Get Free Report) in a report issued on Wednesday. The firm set a "hold" rating and a $23.00 price target on the chip maker's stock. Deutsche Bank Aktiengesellschaft's target price would indicate a potential upside of 7.80% from the stock's previous close.

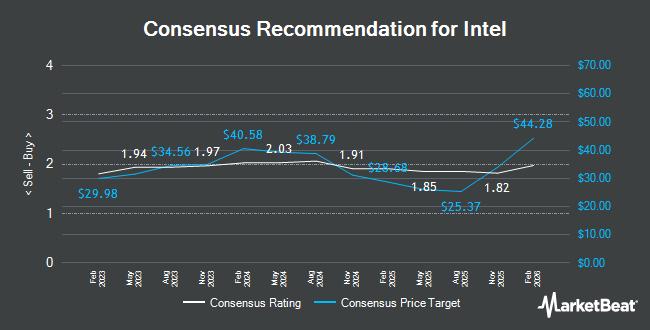

Several other brokerages also recently commented on INTC. Mizuho dropped their target price on shares of Intel from $23.00 to $22.00 and set a "neutral" rating on the stock in a report on Friday, April 25th. Benchmark reiterated a "hold" rating on shares of Intel in a report on Friday, April 25th. Truist Financial dropped their target price on shares of Intel from $22.00 to $21.00 and set a "hold" rating on the stock in a report on Friday, January 31st. Needham & Company LLC reiterated a "hold" rating on shares of Intel in a report on Friday, April 25th. Finally, Wedbush dropped their target price on shares of Intel from $20.00 to $19.00 and set a "neutral" rating on the stock in a report on Wednesday, April 23rd. Six equities research analysts have rated the stock with a sell rating, twenty-five have assigned a hold rating and one has given a buy rating to the company. Based on data from MarketBeat, Intel currently has a consensus rating of "Hold" and a consensus target price of $21.57.

Check Out Our Latest Analysis on Intel

Intel Stock Up 0.3%

Shares of INTC stock traded up $0.07 on Wednesday, hitting $21.34. The company's stock had a trading volume of 4,510,418 shares, compared to its average volume of 80,369,167. The company has a debt-to-equity ratio of 0.44, a current ratio of 1.33 and a quick ratio of 0.98. Intel has a fifty-two week low of $17.67 and a fifty-two week high of $37.16. The firm's fifty day moving average price is $21.36 and its 200-day moving average price is $21.66. The stock has a market capitalization of $93.06 billion, a price-to-earnings ratio of -4.88 and a beta of 1.15.

Intel (NASDAQ:INTC - Get Free Report) last released its quarterly earnings data on Thursday, April 24th. The chip maker reported $0.13 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.01 by $0.12. Intel had a negative net margin of 35.32% and a negative return on equity of 3.27%. The business had revenue of $12.67 billion during the quarter, compared to analyst estimates of $12.26 billion. During the same quarter in the previous year, the business earned $0.18 EPS. Intel's quarterly revenue was down .4% compared to the same quarter last year. Research analysts anticipate that Intel will post -0.11 EPS for the current year.

Hedge Funds Weigh In On Intel

Several large investors have recently bought and sold shares of INTC. Norges Bank bought a new stake in Intel in the fourth quarter valued at approximately $1,246,569,000. Nuveen LLC bought a new stake in shares of Intel during the first quarter worth $538,430,000. Price T Rowe Associates Inc. MD increased its position in shares of Intel by 99.8% during the first quarter. Price T Rowe Associates Inc. MD now owns 29,829,385 shares of the chip maker's stock worth $677,426,000 after acquiring an additional 14,901,457 shares in the last quarter. Two Sigma Advisers LP bought a new stake in shares of Intel during the fourth quarter worth $289,752,000. Finally, Two Sigma Investments LP bought a new stake in shares of Intel during the fourth quarter worth $237,457,000. 64.53% of the stock is currently owned by institutional investors and hedge funds.

About Intel

(

Get Free Report)

Intel Corporation designs, develops, manufactures, markets, and sells computing and related products and services worldwide. It operates through Client Computing Group, Data Center and AI, Network and Edge, Mobileye, and Intel Foundry Services segments. The company's products portfolio comprises central processing units and chipsets, system-on-chips (SoCs), and multichip packages; mobile and desktop processors; hardware products comprising graphics processing units (GPUs), domain-specific accelerators, and field programmable gate arrays (FPGAs); and memory and storage, connectivity and networking, and other semiconductor products.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.