Invenomic Capital Management LP reduced its position in shares of PENN Entertainment, Inc. (NASDAQ:PENN - Free Report) by 13.7% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 989,765 shares of the company's stock after selling 157,725 shares during the quarter. PENN Entertainment comprises approximately 0.9% of Invenomic Capital Management LP's holdings, making the stock its 26th largest holding. Invenomic Capital Management LP owned 0.65% of PENN Entertainment worth $19,617,000 at the end of the most recent quarter.

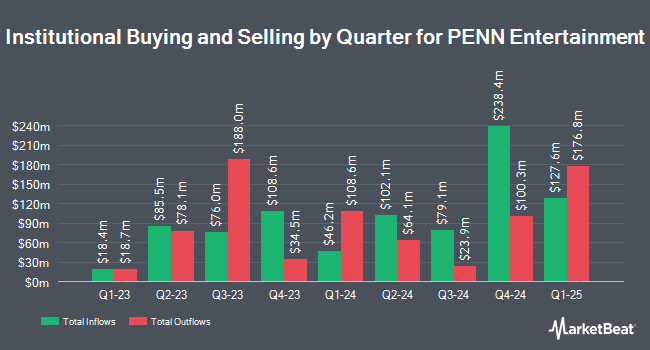

Other institutional investors and hedge funds have also recently modified their holdings of the company. IFP Advisors Inc lifted its position in PENN Entertainment by 201.5% during the fourth quarter. IFP Advisors Inc now owns 1,574 shares of the company's stock valued at $31,000 after purchasing an additional 1,052 shares during the last quarter. Lee Danner & Bass Inc. bought a new position in shares of PENN Entertainment during the 4th quarter valued at approximately $92,000. KBC Group NV boosted its stake in PENN Entertainment by 36.5% during the fourth quarter. KBC Group NV now owns 5,501 shares of the company's stock worth $109,000 after buying an additional 1,470 shares during the period. CIBC Private Wealth Group LLC increased its position in PENN Entertainment by 914.4% during the fourth quarter. CIBC Private Wealth Group LLC now owns 6,492 shares of the company's stock valued at $119,000 after acquiring an additional 5,852 shares during the last quarter. Finally, Sterling Capital Management LLC raised its stake in shares of PENN Entertainment by 51.8% in the fourth quarter. Sterling Capital Management LLC now owns 9,030 shares of the company's stock valued at $179,000 after acquiring an additional 3,080 shares during the period. 91.69% of the stock is owned by hedge funds and other institutional investors.

PENN Entertainment Stock Up 2.0 %

NASDAQ:PENN opened at $15.59 on Friday. The company has a debt-to-equity ratio of 2.34, a quick ratio of 0.94 and a current ratio of 0.94. The stock has a market capitalization of $2.35 billion, a P/E ratio of -4.39, a P/E/G ratio of 1.55 and a beta of 1.81. The company's 50-day simple moving average is $15.97 and its 200-day simple moving average is $18.77. PENN Entertainment, Inc. has a fifty-two week low of $13.25 and a fifty-two week high of $23.08.

PENN Entertainment (NASDAQ:PENN - Get Free Report) last issued its quarterly earnings results on Thursday, May 8th. The company reported ($0.25) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.29) by $0.04. PENN Entertainment had a negative return on equity of 14.44% and a negative net margin of 8.51%. The business had revenue of $1.67 billion for the quarter, compared to the consensus estimate of $1.71 billion. During the same period in the prior year, the firm posted ($0.76) earnings per share. The business's quarterly revenue was up 4.1% on a year-over-year basis. On average, equities analysts anticipate that PENN Entertainment, Inc. will post -1.61 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of equities analysts recently commented on the stock. JMP Securities reiterated a "market perform" rating on shares of PENN Entertainment in a report on Thursday, January 16th. Susquehanna cut their target price on PENN Entertainment from $26.00 to $23.00 and set a "positive" rating on the stock in a research note on Tuesday, April 15th. Wells Fargo & Company raised their price target on PENN Entertainment from $20.00 to $24.00 and gave the stock an "equal weight" rating in a research note on Monday, March 3rd. Stifel Nicolaus reduced their target price on PENN Entertainment from $22.00 to $19.00 and set a "hold" rating on the stock in a research note on Tuesday, March 18th. Finally, StockNews.com upgraded shares of PENN Entertainment from a "sell" rating to a "hold" rating in a report on Monday, March 3rd. Eleven investment analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $22.97.

Read Our Latest Stock Report on PENN

About PENN Entertainment

(

Free Report)

PENN Entertainment, Inc, together with its subsidiaries, provides integrated entertainment, sports content, and casino gaming experiences. The company operates through five segments: Northeast, South, West, Midwest, and Interactive. It operates online sports betting in various jurisdictions; and iCasino under Hollywood Casino, L'Auberge, ESPN BET, and theScore Bet Sportsbook and Casino brands.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PENN Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PENN Entertainment wasn't on the list.

While PENN Entertainment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.