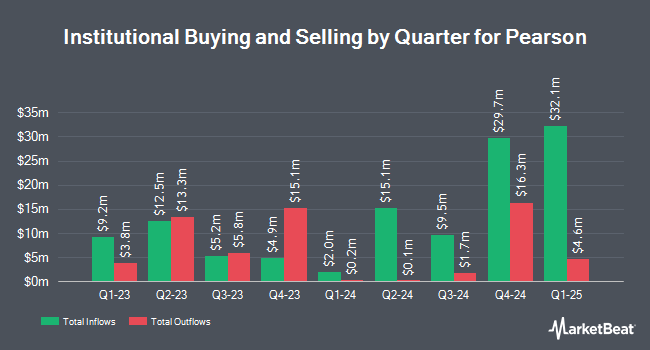

Invesco Ltd. trimmed its position in Pearson plc (NYSE:PSO - Free Report) by 25.7% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 758,321 shares of the company's stock after selling 261,685 shares during the quarter. Invesco Ltd. owned 0.11% of Pearson worth $12,224,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. Versant Capital Management Inc bought a new position in shares of Pearson during the fourth quarter valued at approximately $26,000. SBI Securities Co. Ltd. purchased a new position in shares of Pearson in the fourth quarter worth approximately $27,000. Wilmington Savings Fund Society FSB purchased a new position in Pearson during the third quarter valued at $47,000. Smartleaf Asset Management LLC lifted its position in shares of Pearson by 228.0% during the 4th quarter. Smartleaf Asset Management LLC now owns 4,044 shares of the company's stock valued at $65,000 after buying an additional 2,811 shares in the last quarter. Finally, Russell Investments Group Ltd. grew its stake in shares of Pearson by 251.4% during the 4th quarter. Russell Investments Group Ltd. now owns 5,247 shares of the company's stock valued at $85,000 after acquiring an additional 3,754 shares during the period. Institutional investors own 2.14% of the company's stock.

Pearson Stock Performance

NYSE:PSO traded down $0.20 during trading hours on Friday, hitting $15.68. 676,794 shares of the company were exchanged, compared to its average volume of 449,153. The company has a debt-to-equity ratio of 0.34, a current ratio of 1.78 and a quick ratio of 1.72. The company's 50 day moving average price is $16.18 and its 200-day moving average price is $15.75. Pearson plc has a 52-week low of $11.78 and a 52-week high of $17.90. The stock has a market capitalization of $10.44 billion, a price-to-earnings ratio of 16.68, a PEG ratio of 2.65 and a beta of 0.42.

Pearson Increases Dividend

The business also recently disclosed a semi-annual dividend, which will be paid on Friday, May 16th. Shareholders of record on Friday, March 21st will be paid a dividend of $0.2092 per share. The ex-dividend date of this dividend is Friday, March 21st. This represents a dividend yield of 1.7%. This is a positive change from Pearson's previous semi-annual dividend of $0.10. Pearson's dividend payout ratio (DPR) is presently 43.62%.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on PSO. StockNews.com raised shares of Pearson from a "hold" rating to a "buy" rating in a report on Monday, March 3rd. The Goldman Sachs Group initiated coverage on Pearson in a research report on Wednesday, March 26th. They issued a "buy" rating for the company. Finally, National Bankshares set a $18.00 target price on Pearson in a research report on Tuesday, February 18th.

Read Our Latest Analysis on Pearson

About Pearson

(

Free Report)

Pearson plc offers educational courseware, assessments, and services in the United Kingdom, the United States, Canada, the Asia Pacific, other European countries, and internationally. The company operates through five segments: Assessment & Qualifications, Virtual Learning, English Language Learning, Workforce Skills, and Higher Education.

Featured Stories

Before you consider Pearson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pearson wasn't on the list.

While Pearson currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.