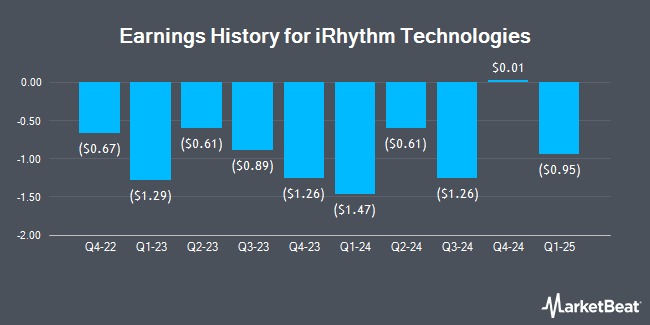

iRhythm Technologies (NASDAQ:IRTC - Get Free Report) is anticipated to release its Q1 2025 earnings data after the market closes on Thursday, May 1st. Analysts expect iRhythm Technologies to post earnings of ($0.89) per share and revenue of $153.39 million for the quarter.

iRhythm Technologies (NASDAQ:IRTC - Get Free Report) last announced its quarterly earnings results on Thursday, February 20th. The company reported $0.01 EPS for the quarter, beating the consensus estimate of ($0.29) by $0.30. iRhythm Technologies had a negative net margin of 19.14% and a negative return on equity of 118.83%. The company had revenue of $164.33 million for the quarter, compared to analyst estimates of $158.30 million. On average, analysts expect iRhythm Technologies to post $-2 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

iRhythm Technologies Stock Performance

Shares of NASDAQ:IRTC traded down $1.39 during trading hours on Tuesday, hitting $105.26. The stock had a trading volume of 26,930 shares, compared to its average volume of 456,693. The stock's fifty day simple moving average is $104.35 and its 200 day simple moving average is $95.44. iRhythm Technologies has a 1-year low of $55.92 and a 1-year high of $128.52. The firm has a market capitalization of $3.36 billion, a price-to-earnings ratio of -28.92 and a beta of 1.45. The company has a debt-to-equity ratio of 9.00, a quick ratio of 6.12 and a current ratio of 6.27.

Analysts Set New Price Targets

A number of research firms recently commented on IRTC. Needham & Company LLC raised their price objective on shares of iRhythm Technologies from $125.00 to $138.00 and gave the company a "buy" rating in a research note on Friday, February 21st. The Goldman Sachs Group raised their price objective on shares of iRhythm Technologies from $91.00 to $124.00 and gave the company a "neutral" rating in a research note on Monday, February 24th. Wells Fargo & Company raised their price objective on shares of iRhythm Technologies from $86.00 to $104.00 and gave the company an "equal weight" rating in a research note on Friday, February 21st. Oppenheimer raised their price objective on shares of iRhythm Technologies from $105.00 to $120.00 and gave the company an "outperform" rating in a research note on Wednesday, January 8th. Finally, StockNews.com upgraded shares of iRhythm Technologies from a "sell" rating to a "hold" rating in a report on Monday, February 24th. Three research analysts have rated the stock with a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat, iRhythm Technologies presently has an average rating of "Moderate Buy" and a consensus price target of $119.73.

View Our Latest Stock Report on IRTC

About iRhythm Technologies

(

Get Free Report)

iRhythm Technologies, Inc, a digital healthcare company, engages in the design, development, and commercialization of device-based technology to provide ambulatory cardiac monitoring services to diagnose arrhythmias in the United States. It offers Zio services, an ambulatory monitoring solution, including long-term and short-term continuous monitoring and mobile cardiac telemetry monitoring services.

Featured Stories

Before you consider iRhythm Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iRhythm Technologies wasn't on the list.

While iRhythm Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.