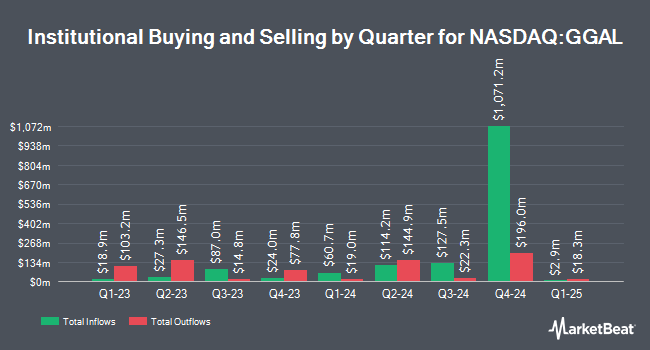

Itau Unibanco Holding S.A. grew its stake in Grupo Financiero Galicia S.A. (NASDAQ:GGAL - Free Report) by 402.3% during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 221,004 shares of the bank's stock after purchasing an additional 177,004 shares during the period. Itau Unibanco Holding S.A. owned about 0.15% of Grupo Financiero Galicia worth $13,827,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. JPMorgan Chase & Co. grew its holdings in shares of Grupo Financiero Galicia by 267.2% during the third quarter. JPMorgan Chase & Co. now owns 92,505 shares of the bank's stock worth $3,894,000 after purchasing an additional 67,312 shares during the last quarter. Bank of New Hampshire grew its holdings in Grupo Financiero Galicia by 43.6% during the 4th quarter. Bank of New Hampshire now owns 21,514 shares of the bank's stock worth $1,341,000 after acquiring an additional 6,527 shares during the last quarter. Harbour Capital Advisors LLC acquired a new position in Grupo Financiero Galicia in the 4th quarter valued at approximately $386,000. Assenagon Asset Management S.A. increased its position in Grupo Financiero Galicia by 436.9% in the 4th quarter. Assenagon Asset Management S.A. now owns 191,671 shares of the bank's stock valued at $11,945,000 after acquiring an additional 155,969 shares during the period. Finally, Diversify Wealth Management LLC raised its stake in shares of Grupo Financiero Galicia by 15.5% during the fourth quarter. Diversify Wealth Management LLC now owns 32,128 shares of the bank's stock valued at $2,002,000 after acquiring an additional 4,309 shares during the last quarter.

Grupo Financiero Galicia Trading Up 2.6 %

Shares of Grupo Financiero Galicia stock traded up $1.47 during trading on Tuesday, hitting $58.82. The company's stock had a trading volume of 381,867 shares, compared to its average volume of 1,097,512. The stock has a market cap of $8.67 billion, a price-to-earnings ratio of 8.68 and a beta of 1.79. The company has a debt-to-equity ratio of 0.10, a current ratio of 1.11 and a quick ratio of 1.11. Grupo Financiero Galicia S.A. has a 52 week low of $23.53 and a 52 week high of $74.00. The stock has a 50-day moving average price of $56.83 and a two-hundred day moving average price of $59.56.

Grupo Financiero Galicia Profile

(

Free Report)

Grupo Financiero Galicia SA, a financial service holding company, provides various financial products and services to individuals and companies in Argentina. The company operates through Banks, NaranjaX, Insurance, and Other Businesses segments. It also offers personal loans; express and mortgage loans; pledge and credit card loans; credit and debit cards; and online banking services, as well as savings, deposits, and checking accounts related services.

See Also

Before you consider Grupo Financiero Galicia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grupo Financiero Galicia wasn't on the list.

While Grupo Financiero Galicia currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.