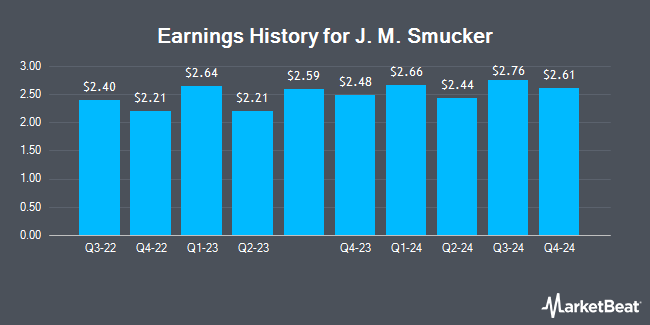

J. M. Smucker (NYSE:SJM - Get Free Report) is expected to issue its Q4 2025 quarterly earnings data before the market opens on Tuesday, June 10th. Analysts expect the company to announce earnings of $2.25 per share and revenue of $2.18 billion for the quarter.

J. M. Smucker Trading Down 0.3%

NYSE SJM traded down $0.36 during trading hours on Wednesday, reaching $112.14. The company had a trading volume of 895,330 shares, compared to its average volume of 1,207,105. The company has a current ratio of 0.58, a quick ratio of 0.27 and a debt-to-equity ratio of 0.89. The stock has a market capitalization of $11.93 billion, a P/E ratio of 22.70, a price-to-earnings-growth ratio of 3.91 and a beta of 0.35. The stock has a 50-day moving average of $114.27 and a 200 day moving average of $111.24. J. M. Smucker has a 1-year low of $98.77 and a 1-year high of $125.42.

J. M. Smucker Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, June 2nd. Stockholders of record on Friday, May 16th were issued a $1.08 dividend. The ex-dividend date was Friday, May 16th. This represents a $4.32 annualized dividend and a dividend yield of 3.85%. J. M. Smucker's dividend payout ratio is currently -179.25%.

Insider Buying and Selling

In other news, insider Jill R. Penrose sold 5,117 shares of the business's stock in a transaction dated Friday, March 28th. The stock was sold at an average price of $116.26, for a total value of $594,902.42. Following the completion of the sale, the insider now directly owns 8,794 shares of the company's stock, valued at approximately $1,022,390.44. The trade was a 36.78% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Tucker H. Marshall sold 5,028 shares of J. M. Smucker stock in a transaction that occurred on Thursday, March 13th. The stock was sold at an average price of $113.36, for a total value of $569,974.08. Following the transaction, the chief financial officer now directly owns 13,263 shares in the company, valued at approximately $1,503,493.68. This trade represents a 27.49% decrease in their position. The disclosure for this sale can be found here. 3.40% of the stock is owned by company insiders.

Hedge Funds Weigh In On J. M. Smucker

Hedge funds and other institutional investors have recently made changes to their positions in the stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of J. M. Smucker by 10.0% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 19,440 shares of the company's stock valued at $2,286,000 after purchasing an additional 1,763 shares during the last quarter. United Services Automobile Association acquired a new position in shares of J. M. Smucker during the first quarter worth about $253,000. Woodline Partners LP raised its holdings in J. M. Smucker by 40.7% during the first quarter. Woodline Partners LP now owns 8,990 shares of the company's stock worth $1,065,000 after purchasing an additional 2,600 shares in the last quarter. Finally, Empowered Funds LLC lifted its position in J. M. Smucker by 28.6% in the first quarter. Empowered Funds LLC now owns 12,992 shares of the company's stock valued at $1,538,000 after purchasing an additional 2,889 shares during the period. Hedge funds and other institutional investors own 81.66% of the company's stock.

Analyst Upgrades and Downgrades

SJM has been the subject of several research reports. DA Davidson dropped their target price on shares of J. M. Smucker from $122.00 to $120.00 and set a "neutral" rating for the company in a report on Tuesday, March 11th. Jefferies Financial Group reiterated a "hold" rating on shares of J. M. Smucker in a report on Wednesday, May 28th. UBS Group started coverage on J. M. Smucker in a report on Wednesday, April 23rd. They set a "buy" rating and a $134.00 target price for the company. Citigroup cut their price target on shares of J. M. Smucker from $129.00 to $128.00 and set a "buy" rating on the stock in a research note on Monday, May 19th. Finally, Morgan Stanley assumed coverage on shares of J. M. Smucker in a report on Monday, March 24th. They issued an "overweight" rating and a $123.00 price objective for the company. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $125.70.

View Our Latest Research Report on J. M. Smucker

About J. M. Smucker

(

Get Free Report)

The J. M. Smucker Company manufactures and markets branded food and beverage products worldwide. It operates in three segments: U.S. Retail Pet Foods, U.S. Retail Coffee, and U.S. Retail Consumer Foods. The company offers mainstream roast, ground, single serve, and premium coffee; peanut butter and specialty spreads; fruit spreads, toppings, and syrups; jelly products; nut mix products; shortening and oils; frozen sandwiches and snacks; pet food and pet snacks; and foodservice hot beverage, foodservice portion control, and flour products, as well as dog and cat food, frozen handheld products, juices and beverages, and baking mixes and ingredients.

See Also

Before you consider J. M. Smucker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and J. M. Smucker wasn't on the list.

While J. M. Smucker currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.