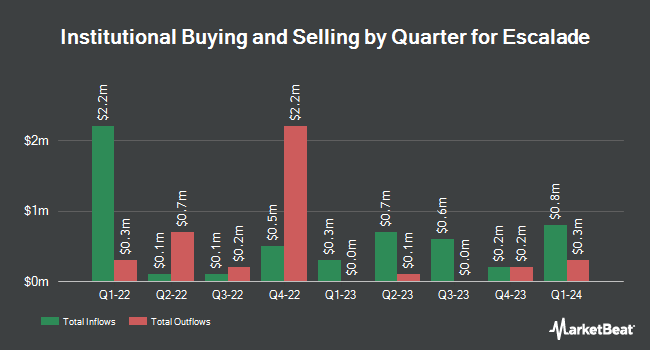

JPMorgan Chase & Co. raised its position in Escalade, Incorporated (NASDAQ:ESCA - Free Report) by 98.1% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 37,474 shares of the company's stock after purchasing an additional 18,560 shares during the period. JPMorgan Chase & Co. owned 0.27% of Escalade worth $535,000 at the end of the most recent reporting period.

Other hedge funds have also recently made changes to their positions in the company. Barclays PLC grew its position in Escalade by 251.3% during the third quarter. Barclays PLC now owns 13,185 shares of the company's stock worth $186,000 after buying an additional 9,432 shares in the last quarter. Bank of New York Mellon Corp boosted its position in shares of Escalade by 6.4% during the 4th quarter. Bank of New York Mellon Corp now owns 127,446 shares of the company's stock valued at $1,820,000 after acquiring an additional 7,659 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. grew its holdings in shares of Escalade by 8.4% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 28,786 shares of the company's stock worth $411,000 after purchasing an additional 2,221 shares in the last quarter. 65.22% of the stock is currently owned by hedge funds and other institutional investors.

Escalade Price Performance

ESCA traded up $0.19 on Tuesday, reaching $15.02. The company had a trading volume of 19,698 shares, compared to its average volume of 21,358. Escalade, Incorporated has a 52-week low of $12.53 and a 52-week high of $16.99. The company has a market cap of $205.16 million, a price-to-earnings ratio of 15.97 and a beta of 0.88. The company has a debt-to-equity ratio of 0.13, a quick ratio of 1.41 and a current ratio of 3.45. The business has a 50 day simple moving average of $15.01 and a 200 day simple moving average of $14.89.

Escalade (NASDAQ:ESCA - Get Free Report) last posted its quarterly earnings data on Monday, May 5th. The company reported $0.19 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.13 by $0.06. The company had revenue of $55.48 million during the quarter, compared to the consensus estimate of $54.44 million. Escalade had a net margin of 5.20% and a return on equity of 7.17%. As a group, sell-side analysts anticipate that Escalade, Incorporated will post 0.93 EPS for the current year.

Escalade Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, July 14th. Investors of record on Monday, July 7th will be given a $0.15 dividend. The ex-dividend date of this dividend is Monday, July 7th. This represents a $0.60 dividend on an annualized basis and a yield of 4.00%. Escalade's payout ratio is 65.22%.

Escalade Company Profile

(

Free Report)

Escalade, Incorporated, together with its subsidiaries, manufactures, distributes, imports, and sells sporting goods in North America, Europe, and internationally. The company provides various sporting goods brands in basketball goals, archery, indoor and outdoor game recreation, and fitness products.

See Also

Before you consider Escalade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Escalade wasn't on the list.

While Escalade currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.