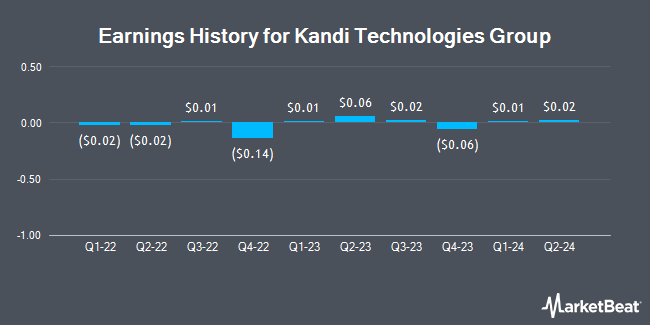

Kandi Technologies Group (NASDAQ:KNDI - Get Free Report) issued its quarterly earnings results on Monday. The company reported ($0.28) earnings per share for the quarter, missing the consensus estimate of ($0.02) by ($0.26), Zacks reports. The business had revenue of $41.00 million for the quarter, compared to the consensus estimate of $41.00 million. Kandi Technologies Group had a negative return on equity of 1.53% and a negative net margin of 5.25%.

Kandi Technologies Group Stock Performance

Shares of Kandi Technologies Group stock traded up $0.04 on Friday, hitting $1.18. The stock had a trading volume of 67,388 shares, compared to its average volume of 157,154. The stock has a market cap of $101.56 million, a price-to-earnings ratio of -14.75 and a beta of 1.15. The company has a quick ratio of 2.55, a current ratio of 3.26 and a debt-to-equity ratio of 0.02. Kandi Technologies Group has a twelve month low of $0.89 and a twelve month high of $2.53. The business's 50 day moving average is $1.33 and its two-hundred day moving average is $1.23.

Analyst Ratings Changes

Separately, StockNews.com downgraded Kandi Technologies Group from a "hold" rating to a "sell" rating in a research note on Tuesday, March 18th.

View Our Latest Stock Analysis on Kandi Technologies Group

About Kandi Technologies Group

(

Get Free Report)

Kandi Technologies Group, Inc engages in designing, developing, manufacturing, and commercializing electric vehicle (EV) products and parts in the People's Republic of China and the United States. It offers also off-road vehicles, including all-terrain vehicles, utility vehicles, go-karts, electric scooters, and electric self-balancing scooters, as well as related parts; and battery packs and smart battery swap system.

Read More

Before you consider Kandi Technologies Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kandi Technologies Group wasn't on the list.

While Kandi Technologies Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.