Kennedy Capital Management LLC trimmed its stake in Arcosa, Inc. (NYSE:ACA - Free Report) by 4.0% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 90,230 shares of the company's stock after selling 3,733 shares during the quarter. Kennedy Capital Management LLC owned approximately 0.18% of Arcosa worth $8,729,000 as of its most recent filing with the Securities & Exchange Commission.

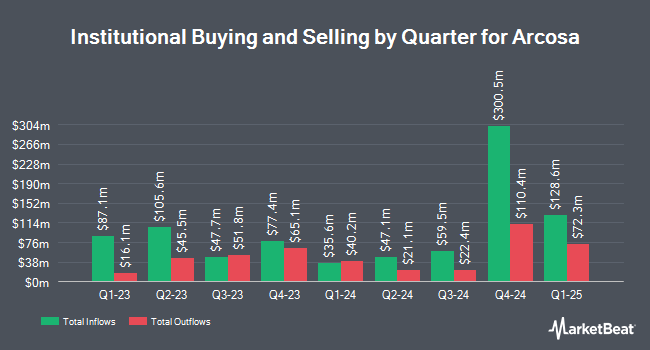

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Neuberger Berman Group LLC grew its holdings in shares of Arcosa by 21.6% during the fourth quarter. Neuberger Berman Group LLC now owns 3,016,597 shares of the company's stock worth $291,831,000 after purchasing an additional 536,349 shares in the last quarter. Raymond James Financial Inc. bought a new stake in shares of Arcosa in the fourth quarter worth about $15,919,000. FIL Ltd increased its stake in shares of Arcosa by 10.0% during the fourth quarter. FIL Ltd now owns 205,430 shares of the company's stock valued at $19,873,000 after buying an additional 18,671 shares during the period. Cerity Partners LLC lifted its position in shares of Arcosa by 2.3% in the 4th quarter. Cerity Partners LLC now owns 19,736 shares of the company's stock worth $1,882,000 after purchasing an additional 441 shares during the period. Finally, Envestnet Asset Management Inc. raised its position in shares of Arcosa by 6.4% in the 4th quarter. Envestnet Asset Management Inc. now owns 16,312 shares of the company's stock worth $1,578,000 after acquiring an additional 986 shares in the last quarter. Institutional investors own 90.66% of the company's stock.

Arcosa Price Performance

Arcosa stock traded up $0.57 during mid-day trading on Wednesday, reaching $78.07. 110,384 shares of the company's stock traded hands, compared to its average volume of 268,968. The company has a market cap of $3.81 billion, a price-to-earnings ratio of 29.68 and a beta of 0.85. The company has a quick ratio of 2.77, a current ratio of 3.61 and a debt-to-equity ratio of 0.51. The stock has a 50 day moving average of $84.52 and a two-hundred day moving average of $94.56. Arcosa, Inc. has a 12-month low of $68.11 and a 12-month high of $113.43.

Arcosa Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 30th. Investors of record on Tuesday, April 15th will be paid a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a yield of 0.26%. The ex-dividend date of this dividend is Tuesday, April 15th. Arcosa's dividend payout ratio (DPR) is presently 10.47%.

Wall Street Analysts Forecast Growth

Separately, Oppenheimer boosted their target price on Arcosa from $105.00 to $110.00 and gave the stock an "outperform" rating in a report on Tuesday, January 14th.

View Our Latest Stock Analysis on Arcosa

About Arcosa

(

Free Report)

Arcosa, Inc, together with its subsidiaries, provides infrastructure-related products and solutions for the construction, engineered structures, and transportation markets in the United States. It operates through three segments: Construction Products, Engineered Structures, and Transportation Products.

Featured Articles

Before you consider Arcosa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcosa wasn't on the list.

While Arcosa currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.