ADAR1 Capital Management LLC trimmed its position in Keros Therapeutics, Inc. (NASDAQ:KROS - Free Report) by 94.8% in the fourth quarter, according to its most recent filing with the SEC. The institutional investor owned 23,246 shares of the company's stock after selling 422,122 shares during the period. ADAR1 Capital Management LLC owned about 0.06% of Keros Therapeutics worth $368,000 as of its most recent SEC filing.

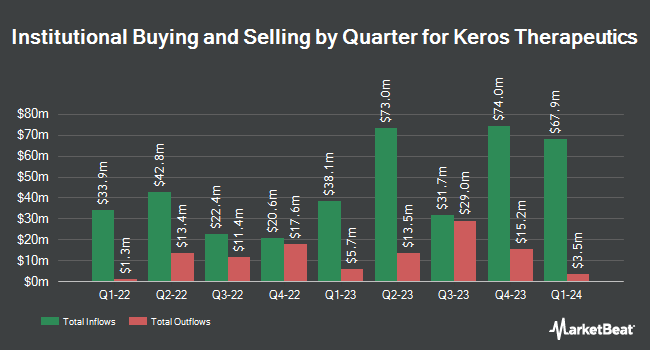

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in KROS. Geode Capital Management LLC grew its holdings in shares of Keros Therapeutics by 6.8% in the third quarter. Geode Capital Management LLC now owns 725,621 shares of the company's stock valued at $42,146,000 after acquiring an additional 46,041 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its position in Keros Therapeutics by 14.3% in the third quarter. Charles Schwab Investment Management Inc. now owns 260,120 shares of the company's stock worth $15,105,000 after purchasing an additional 32,492 shares during the last quarter. SG Americas Securities LLC bought a new position in Keros Therapeutics in the 4th quarter valued at $388,000. Barclays PLC grew its stake in Keros Therapeutics by 140.1% in the 3rd quarter. Barclays PLC now owns 60,014 shares of the company's stock valued at $3,484,000 after purchasing an additional 35,022 shares during the period. Finally, Connor Clark & Lunn Investment Management Ltd. purchased a new stake in shares of Keros Therapeutics during the 4th quarter valued at $461,000. Hedge funds and other institutional investors own 71.56% of the company's stock.

Keros Therapeutics Price Performance

Shares of Keros Therapeutics stock traded down $0.06 during trading hours on Friday, reaching $12.18. The company had a trading volume of 2,357,600 shares, compared to its average volume of 765,122. The firm has a market cap of $494.05 million, a PE ratio of -2.34 and a beta of 1.39. Keros Therapeutics, Inc. has a one year low of $9.12 and a one year high of $72.37. The business has a fifty day simple moving average of $10.91 and a 200 day simple moving average of $30.80.

Keros Therapeutics (NASDAQ:KROS - Get Free Report) last issued its earnings results on Wednesday, February 26th. The company reported ($1.14) EPS for the quarter, topping the consensus estimate of ($1.36) by $0.22. The business had revenue of $3.04 million during the quarter, compared to the consensus estimate of $37.32 million. Keros Therapeutics had a negative return on equity of 41.74% and a negative net margin of 27,890.94%. On average, research analysts forecast that Keros Therapeutics, Inc. will post -4.74 EPS for the current year.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on KROS. Scotiabank reduced their price target on shares of Keros Therapeutics from $44.00 to $41.00 and set a "sector outperform" rating for the company in a research report on Thursday, January 16th. Piper Sandler dropped their target price on shares of Keros Therapeutics from $40.00 to $15.00 and set an "overweight" rating on the stock in a research note on Friday, January 17th. HC Wainwright restated a "buy" rating and set a $40.00 price target on shares of Keros Therapeutics in a research note on Tuesday, April 1st. Wells Fargo & Company lowered their price target on shares of Keros Therapeutics from $28.00 to $26.00 and set an "overweight" rating on the stock in a report on Thursday, February 27th. Finally, Truist Financial reduced their price objective on Keros Therapeutics from $43.00 to $25.00 and set a "buy" rating for the company in a report on Wednesday. Six equities research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $40.33.

Check Out Our Latest Analysis on KROS

Keros Therapeutics Company Profile

(

Free Report)

Keros Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops and commercializes novel therapeutics for patients with disorders that are linked to dysfunctional signaling of the transforming growth factor-beta family of proteins in the United States. The company's lead product candidate is KER-050, which is being developed for the treatment of low blood cell counts, or cytopenias, including anemia and thrombocytopenia in patients with myelodysplastic syndromes, as well as in patients with myelofibrosis.

Further Reading

Before you consider Keros Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keros Therapeutics wasn't on the list.

While Keros Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.