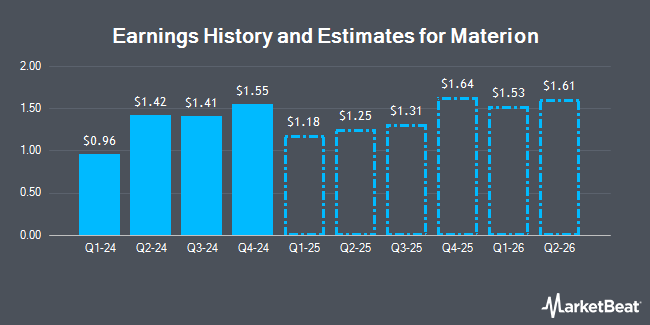

Materion Corporation (NYSE:MTRN - Free Report) - KeyCorp raised their Q3 2025 earnings per share estimates for Materion in a note issued to investors on Thursday, July 17th. KeyCorp analyst P. Gibbs now anticipates that the basic materials company will post earnings per share of $1.23 for the quarter, up from their prior estimate of $1.14. KeyCorp currently has a "Overweight" rating and a $112.00 target price on the stock. The consensus estimate for Materion's current full-year earnings is $5.50 per share. KeyCorp also issued estimates for Materion's Q4 2025 earnings at $1.52 EPS and FY2025 earnings at $5.04 EPS.

Materion (NYSE:MTRN - Get Free Report) last posted its earnings results on Thursday, May 1st. The basic materials company reported $1.13 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.12 by $0.01. The company had revenue of $420.33 million for the quarter, compared to analysts' expectations of $396.83 million. Materion had a return on equity of 12.83% and a net margin of 0.59%. Materion's quarterly revenue was up 9.1% on a year-over-year basis. During the same period last year, the firm earned $0.96 earnings per share.

Separately, Wall Street Zen raised Materion from a "hold" rating to a "buy" rating in a research report on Saturday, July 5th.

Check Out Our Latest Stock Analysis on Materion

Materion Stock Performance

Materion stock opened at $94.24 on Monday. The stock's 50 day simple moving average is $80.70 and its two-hundred day simple moving average is $86.20. The company has a debt-to-equity ratio of 0.46, a quick ratio of 1.20 and a current ratio of 2.84. The stock has a market cap of $1.96 billion, a price-to-earnings ratio of 188.48 and a beta of 0.80. Materion has a fifty-two week low of $69.10 and a fifty-two week high of $123.21.

Materion Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, June 13th. Investors of record on Thursday, May 29th were issued a $0.14 dividend. This is a positive change from Materion's previous quarterly dividend of $0.14. This represents a $0.56 dividend on an annualized basis and a yield of 0.59%. The ex-dividend date was Thursday, May 29th. Materion's payout ratio is presently 112.00%.

Insider Buying and Selling

In other Materion news, VP Gregory R. Chemnitz sold 2,000 shares of Materion stock in a transaction that occurred on Monday, May 5th. The shares were sold at an average price of $80.45, for a total value of $160,900.00. Following the completion of the sale, the vice president owned 13,376 shares of the company's stock, valued at approximately $1,076,099.20. The trade was a 13.01% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 2.60% of the company's stock.

Institutional Investors Weigh In On Materion

A number of large investors have recently added to or reduced their stakes in MTRN. Capital Research Global Investors grew its position in shares of Materion by 16.3% during the 4th quarter. Capital Research Global Investors now owns 1,838,484 shares of the basic materials company's stock valued at $181,789,000 after acquiring an additional 257,637 shares during the period. GAMMA Investing LLC grew its position in shares of Materion by 66,993.5% during the 1st quarter. GAMMA Investing LLC now owns 175,114 shares of the basic materials company's stock valued at $14,289,000 after acquiring an additional 174,853 shares during the period. Nuveen LLC bought a new stake in shares of Materion during the 1st quarter valued at $9,707,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its position in shares of Materion by 41.3% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 289,106 shares of the basic materials company's stock valued at $23,592,000 after acquiring an additional 84,482 shares during the period. Finally, Trigran Investments Inc. grew its position in shares of Materion by 7.7% during the 1st quarter. Trigran Investments Inc. now owns 794,765 shares of the basic materials company's stock valued at $64,853,000 after acquiring an additional 56,935 shares during the period. Institutional investors own 93.56% of the company's stock.

Materion Company Profile

(

Get Free Report)

Materion Corporation, together with its subsidiaries, produces advanced engineered materials used in semiconductor, industrial, aerospace and defense, automotive, energy, consumer electronics, and telecom and data center in the United States, Asia, Europe, and internationally. The company operates in four segments: Performance Materials, Electronic Materials, Precision Optics, and Other.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Materion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Materion wasn't on the list.

While Materion currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.