Kovitz Investment Group Partners LLC increased its stake in Iris Energy Limited (NASDAQ:IREN - Free Report) by 72.3% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 189,245 shares of the company's stock after purchasing an additional 79,392 shares during the period. Kovitz Investment Group Partners LLC owned 0.10% of Iris Energy worth $1,858,000 as of its most recent filing with the Securities & Exchange Commission.

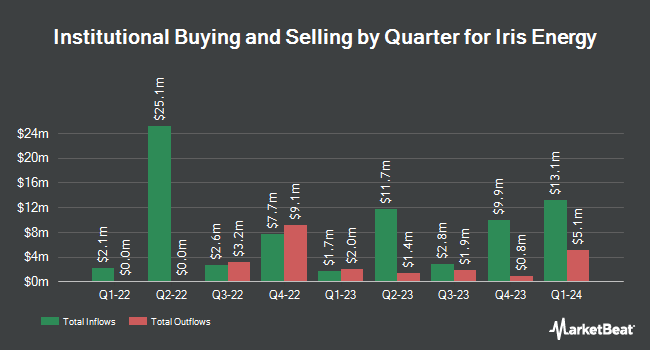

Several other large investors have also added to or reduced their stakes in IREN. Stonebridge Financial Group LLC acquired a new stake in shares of Iris Energy during the 4th quarter valued at about $29,000. HM Payson & Co. purchased a new stake in shares of Iris Energy during the 4th quarter valued at approximately $30,000. R Squared Ltd purchased a new position in shares of Iris Energy during the 4th quarter worth $37,000. Tower Research Capital LLC TRC increased its position in shares of Iris Energy by 1,059.0% during the fourth quarter. Tower Research Capital LLC TRC now owns 8,368 shares of the company's stock valued at $82,000 after acquiring an additional 7,646 shares during the last quarter. Finally, World Equity Group Inc. acquired a new position in Iris Energy during the fourth quarter worth $98,000. Hedge funds and other institutional investors own 41.08% of the company's stock.

Iris Energy Price Performance

Shares of NASDAQ:IREN traded up $0.16 during trading on Friday, hitting $6.53. 18,453,247 shares of the stock were exchanged, compared to its average volume of 15,828,418. Iris Energy Limited has a 1-year low of $4.65 and a 1-year high of $15.92. The company's fifty day simple moving average is $6.57 and its 200-day simple moving average is $9.68.

Iris Energy (NASDAQ:IREN - Get Free Report) last announced its quarterly earnings results on Wednesday, February 12th. The company reported $0.09 earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.04) by $0.13. Iris Energy had a negative net margin of 17.94% and a negative return on equity of 3.98%. Sell-side analysts predict that Iris Energy Limited will post 0.43 earnings per share for the current year.

Wall Street Analyst Weigh In

IREN has been the subject of a number of analyst reports. JPMorgan Chase & Co. raised Iris Energy from a "neutral" rating to an "overweight" rating and lowered their price objective for the stock from $15.00 to $12.00 in a research report on Thursday, March 13th. Cantor Fitzgerald reiterated an "overweight" rating and issued a $23.00 target price on shares of Iris Energy in a research note on Thursday, February 13th. Needham & Company LLC reiterated a "hold" rating on shares of Iris Energy in a research report on Thursday, February 13th. Canaccord Genuity Group raised their price objective on shares of Iris Energy from $17.00 to $23.00 and gave the company a "buy" rating in a research note on Thursday, February 13th. Finally, HC Wainwright upped their target price on Iris Energy from $16.00 to $22.00 and gave the company a "buy" rating in a report on Thursday, February 13th. One investment analyst has rated the stock with a hold rating, ten have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and an average target price of $20.40.

Read Our Latest Stock Report on IREN

About Iris Energy

(

Free Report)

Iris Energy Limited owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

Further Reading

Before you consider Iris Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iris Energy wasn't on the list.

While Iris Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.