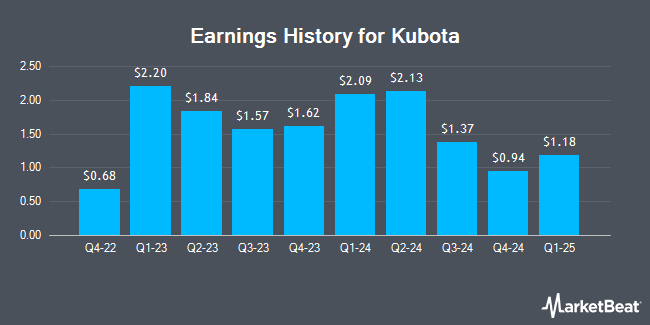

Kubota (OTCMKTS:KUBTY - Get Free Report) issued its quarterly earnings results on Friday. The industrial products company reported $1.18 EPS for the quarter, missing analysts' consensus estimates of $2.10 by ($0.92), Zacks reports. Kubota had a return on equity of 8.73% and a net margin of 7.63%. The company had revenue of $4.91 billion during the quarter, compared to the consensus estimate of $5.17 billion.

Kubota Stock Down 3.5 %

OTCMKTS:KUBTY traded down $2.00 on Friday, reaching $55.00. 28,097 shares of the stock traded hands, compared to its average volume of 47,535. The company has a current ratio of 1.65, a quick ratio of 1.23 and a debt-to-equity ratio of 0.50. The company has a market capitalization of $12.70 billion, a price-to-earnings ratio of 8.42, a PEG ratio of 5.29 and a beta of 1.07. Kubota has a 12 month low of $51.65 and a 12 month high of $80.60. The company's fifty day simple moving average is $59.73 and its 200 day simple moving average is $60.92.

Wall Street Analysts Forecast Growth

Separately, The Goldman Sachs Group raised Kubota from a "strong sell" rating to a "hold" rating in a report on Tuesday, February 4th.

Read Our Latest Stock Report on Kubota

Kubota Company Profile

(

Get Free Report)

Kubota Corporation manufactures and sells agricultural and construction machinery in Japan, North America, Europe, Asia, and internationally. It operates through three segments: Farm & Machinery, Water & Environment, and Others. The Farm & Machinery segment offers tractors, power tillers, combine harvesters, rice transplanters, turf equipment, utility vehicles, other agricultural machinery, implements, attachments, post-harvest machinery, vegetable production equipment, intermediate management machine, and other equipment; cooperative drying, rice seedling, and gardening facilities; scales, weighing and measuring control systems, and air purifier; engines for farm equipment, construction machinery, industrial machinery, and generators; and mini excavators, wheel and skid steer loaders, compact track loaders, and other construction machinery related products.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kubota, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kubota wasn't on the list.

While Kubota currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.