LSV Asset Management raised its position in SM Energy (NYSE:SM - Free Report) by 170.8% during the fourth quarter, according to its most recent filing with the SEC. The institutional investor owned 335,300 shares of the energy company's stock after purchasing an additional 211,500 shares during the period. LSV Asset Management owned 0.29% of SM Energy worth $12,996,000 at the end of the most recent quarter.

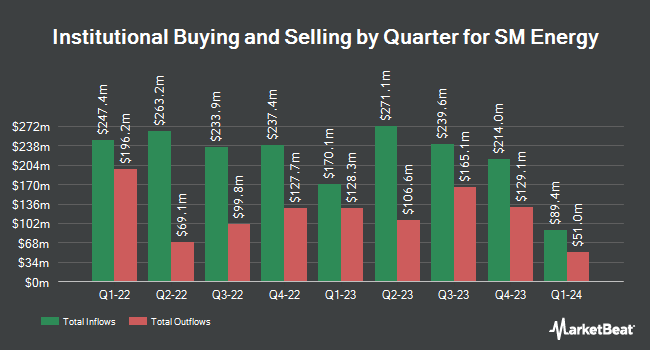

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the business. R Squared Ltd purchased a new position in SM Energy during the fourth quarter worth approximately $61,000. Global Retirement Partners LLC grew its holdings in shares of SM Energy by 51.0% in the fourth quarter. Global Retirement Partners LLC now owns 2,179 shares of the energy company's stock valued at $84,000 after purchasing an additional 736 shares during the period. Smartleaf Asset Management LLC increased its position in SM Energy by 517.9% during the fourth quarter. Smartleaf Asset Management LLC now owns 4,140 shares of the energy company's stock worth $159,000 after purchasing an additional 3,470 shares during the last quarter. KBC Group NV raised its stake in SM Energy by 46.2% during the fourth quarter. KBC Group NV now owns 4,854 shares of the energy company's stock worth $188,000 after purchasing an additional 1,533 shares during the period. Finally, Heritage Family Offices LLP grew its stake in shares of SM Energy by 13.2% in the 4th quarter. Heritage Family Offices LLP now owns 6,237 shares of the energy company's stock valued at $242,000 after buying an additional 726 shares during the period. Institutional investors and hedge funds own 94.56% of the company's stock.

Insider Activity at SM Energy

In other SM Energy news, Director Barton R. Brookman, Jr. purchased 7,000 shares of the stock in a transaction that occurred on Wednesday, February 26th. The stock was purchased at an average cost of $32.36 per share, with a total value of $226,520.00. Following the completion of the acquisition, the director now directly owns 14,666 shares of the company's stock, valued at $474,591.76. This trade represents a 91.31 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 1.50% of the stock is currently owned by corporate insiders.

SM Energy Stock Up 2.8 %

NYSE SM traded up $0.62 during trading hours on Friday, hitting $22.94. 2,060,791 shares of the company were exchanged, compared to its average volume of 1,868,323. The company has a quick ratio of 3.52, a current ratio of 0.55 and a debt-to-equity ratio of 0.66. The firm has a market cap of $2.63 billion, a price-to-earnings ratio of 3.43 and a beta of 3.75. The company has a 50 day moving average of $29.66 and a two-hundred day moving average of $37.60. SM Energy has a 52-week low of $19.67 and a 52-week high of $51.94.

SM Energy (NYSE:SM - Get Free Report) last issued its earnings results on Wednesday, February 19th. The energy company reported $1.91 earnings per share for the quarter, missing the consensus estimate of $2.00 by ($0.09). SM Energy had a net margin of 28.63% and a return on equity of 19.82%. The firm had revenue of $852.22 million during the quarter, compared to analyst estimates of $849.44 million. Equities research analysts anticipate that SM Energy will post 8.1 earnings per share for the current year.

SM Energy Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, May 5th. Investors of record on Friday, April 18th will be paid a dividend of $0.20 per share. The ex-dividend date is Thursday, April 17th. This represents a $0.80 dividend on an annualized basis and a dividend yield of 3.49%. SM Energy's payout ratio is currently 11.98%.

Analyst Ratings Changes

A number of research firms recently commented on SM. Stephens decreased their price objective on SM Energy from $62.00 to $55.00 and set an "overweight" rating on the stock in a report on Tuesday. Williams Trading set a $41.00 price objective on shares of SM Energy in a report on Wednesday, March 5th. Raymond James lowered their target price on shares of SM Energy from $59.00 to $40.00 and set an "outperform" rating for the company in a research note on Monday, March 10th. JPMorgan Chase & Co. decreased their price objective on shares of SM Energy from $54.00 to $41.00 and set a "neutral" rating on the stock in a report on Thursday, March 13th. Finally, StockNews.com downgraded shares of SM Energy from a "buy" rating to a "hold" rating in a report on Friday, February 28th. Seven investment analysts have rated the stock with a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $47.83.

View Our Latest Analysis on SM Energy

SM Energy Company Profile

(

Free Report)

SM Energy Company, an independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas. It has working interests in oil and gas producing wells in the Midland Basin and South Texas. The company was formerly known as St.

See Also

Before you consider SM Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SM Energy wasn't on the list.

While SM Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.