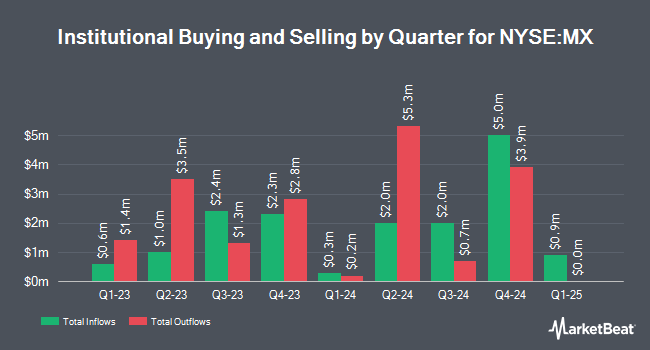

Dimensional Fund Advisors LP trimmed its holdings in Magnachip Semiconductor Co. (NYSE:MX - Free Report) by 9.2% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,010,281 shares of the semiconductor company's stock after selling 101,913 shares during the quarter. Dimensional Fund Advisors LP owned approximately 2.72% of Magnachip Semiconductor worth $4,061,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Empowered Funds LLC boosted its stake in Magnachip Semiconductor by 5.2% in the 4th quarter. Empowered Funds LLC now owns 112,297 shares of the semiconductor company's stock worth $451,000 after purchasing an additional 5,588 shares during the period. Charles Schwab Investment Management Inc. raised its holdings in shares of Magnachip Semiconductor by 61.7% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 165,552 shares of the semiconductor company's stock worth $666,000 after acquiring an additional 63,175 shares in the last quarter. XTX Topco Ltd purchased a new stake in shares of Magnachip Semiconductor during the 4th quarter worth approximately $145,000. Renaissance Technologies LLC raised its holdings in shares of Magnachip Semiconductor by 23.0% during the 4th quarter. Renaissance Technologies LLC now owns 237,900 shares of the semiconductor company's stock worth $956,000 after acquiring an additional 44,546 shares in the last quarter. Finally, R Squared Ltd purchased a new stake in shares of Magnachip Semiconductor during the 4th quarter worth approximately $32,000. 74.26% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several analysts have recently issued reports on MX shares. StockNews.com raised Magnachip Semiconductor from a "sell" rating to a "hold" rating in a report on Thursday, March 13th. Needham & Company LLC reaffirmed a "buy" rating and set a $6.00 price objective on shares of Magnachip Semiconductor in a report on Tuesday, May 13th.

Read Our Latest Research Report on Magnachip Semiconductor

Magnachip Semiconductor Trading Up 4.3%

NYSE:MX traded up $0.17 during midday trading on Friday, hitting $4.13. 824,323 shares of the company traded hands, compared to its average volume of 240,856. The firm's fifty day moving average is $3.31 and its 200-day moving average is $3.87. Magnachip Semiconductor Co. has a 12-month low of $2.51 and a 12-month high of $5.98. The firm has a market capitalization of $149.02 million, a P/E ratio of -3.56 and a beta of 0.77. The company has a current ratio of 4.81, a quick ratio of 4.09 and a debt-to-equity ratio of 0.10.

Magnachip Semiconductor Company Profile

(

Free Report)

Magnachip Semiconductor Corporation, together with its subsidiaries, designs, manufactures, and supplies analog and mixed-signal semiconductor platform solutions for communications, the Internet of Things, consumer, computing, industrial, and automotive applications. It provides display solutions, including source and gate drivers, and timing controllers that cover a range of flat panel displays used in mobile communications, automotive, entertainment devices, monitors, notebook PCs, tablet PC and TVs applied with liquid crystal display, organic light emitting diodes (OLED), and micro light emitting diode (Micro LED) panel.

Featured Articles

Before you consider Magnachip Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magnachip Semiconductor wasn't on the list.

While Magnachip Semiconductor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.