Wall Street Zen upgraded shares of Main Street Capital (NYSE:MAIN - Free Report) from a sell rating to a hold rating in a research note published on Friday morning.

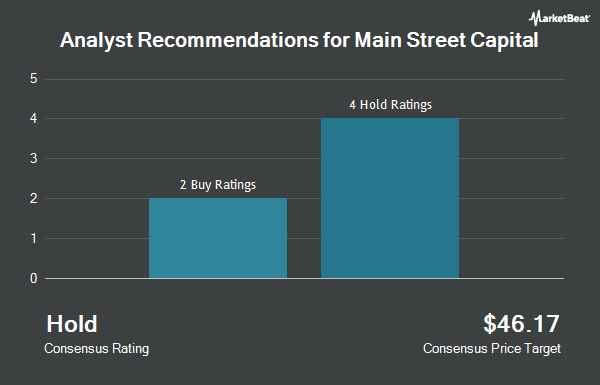

MAIN has been the topic of a number of other reports. B. Riley upgraded shares of Main Street Capital to a "hold" rating in a research note on Monday, June 16th. Oppenheimer restated a "market perform" rating on shares of Main Street Capital in a research note on Tuesday, May 13th. UBS Group reduced their price target on shares of Main Street Capital from $55.00 to $54.00 and set a "neutral" rating on the stock in a research note on Thursday, April 17th. Finally, Truist Financial reduced their price target on shares of Main Street Capital from $62.00 to $54.00 and set a "hold" rating on the stock in a research note on Monday, May 12th. Five investment analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat, Main Street Capital has a consensus rating of "Hold" and a consensus price target of $52.80.

View Our Latest Stock Analysis on Main Street Capital

Main Street Capital Price Performance

Main Street Capital stock traded up $0.15 during trading hours on Friday, reaching $59.11. 509,540 shares of the stock were exchanged, compared to its average volume of 474,254. The company has a market cap of $5.26 billion, a P/E ratio of 10.04 and a beta of 0.82. The company has a current ratio of 0.10, a quick ratio of 0.10 and a debt-to-equity ratio of 0.12. Main Street Capital has a twelve month low of $45.00 and a twelve month high of $63.32. The stock has a 50 day moving average of $55.95 and a two-hundred day moving average of $57.22.

Main Street Capital (NYSE:MAIN - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The financial services provider reported $1.01 earnings per share for the quarter, beating analysts' consensus estimates of $1.00 by $0.01. Main Street Capital had a net margin of 94.61% and a return on equity of 13.02%. The company had revenue of $137.05 million for the quarter, compared to the consensus estimate of $137.50 million. Equities analysts expect that Main Street Capital will post 4.11 EPS for the current fiscal year.

Main Street Capital Increases Dividend

The firm also recently announced a dividend, which was paid on Friday, June 27th. Investors of record on Monday, June 23rd were given a dividend of $0.30 per share. The ex-dividend date of this dividend was Friday, June 20th. This is an increase from Main Street Capital's previous dividend of $0.25. This represents a yield of 7.26%. Main Street Capital's dividend payout ratio (DPR) is currently 50.93%.

Insider Buying and Selling

In related news, EVP Jason B. Beauvais sold 13,664 shares of Main Street Capital stock in a transaction that occurred on Friday, June 27th. The shares were sold at an average price of $59.37, for a total transaction of $811,231.68. Following the sale, the executive vice president directly owned 181,526 shares in the company, valued at $10,777,198.62. This trade represents a 7.00% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 4.09% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Main Street Capital

Several hedge funds have recently added to or reduced their stakes in the business. Burgundy Asset Management Ltd. lifted its position in shares of Main Street Capital by 1.5% in the 4th quarter. Burgundy Asset Management Ltd. now owns 1,153,600 shares of the financial services provider's stock worth $67,578,000 after purchasing an additional 17,196 shares during the period. Jones Financial Companies Lllp lifted its position in shares of Main Street Capital by 45,123.0% in the 1st quarter. Jones Financial Companies Lllp now owns 590,613 shares of the financial services provider's stock worth $33,405,000 after purchasing an additional 589,307 shares during the period. Invesco Ltd. lifted its position in shares of Main Street Capital by 282.5% in the 1st quarter. Invesco Ltd. now owns 532,267 shares of the financial services provider's stock worth $30,105,000 after purchasing an additional 393,101 shares during the period. Adell Harriman & Carpenter Inc. lifted its position in shares of Main Street Capital by 5.2% in the 1st quarter. Adell Harriman & Carpenter Inc. now owns 447,642 shares of the financial services provider's stock worth $25,319,000 after purchasing an additional 22,090 shares during the period. Finally, LPL Financial LLC lifted its position in shares of Main Street Capital by 2.7% in the 1st quarter. LPL Financial LLC now owns 307,368 shares of the financial services provider's stock worth $17,385,000 after purchasing an additional 8,203 shares during the period. 20.31% of the stock is currently owned by institutional investors and hedge funds.

About Main Street Capital

(

Get Free Report)

Main Street Capital Corporation is a business development company specializes in equity capital to lower middle market companies. The firm specializing in recapitalizations, management buyouts, refinancing, family estate planning, management buyouts, refinancing, industry consolidation, mature, later stage emerging growth.

See Also

Before you consider Main Street Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Main Street Capital wasn't on the list.

While Main Street Capital currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.