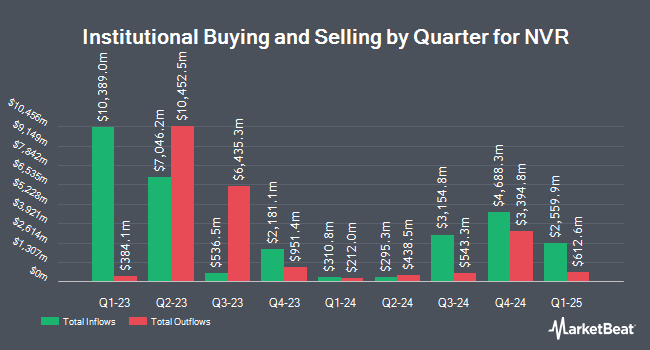

Man Group plc cut its stake in shares of NVR, Inc. (NYSE:NVR - Free Report) by 39.3% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 6,128 shares of the construction company's stock after selling 3,966 shares during the quarter. Man Group plc owned approximately 0.20% of NVR worth $50,120,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently modified their holdings of NVR. EverSource Wealth Advisors LLC raised its position in NVR by 150.0% during the 4th quarter. EverSource Wealth Advisors LLC now owns 5 shares of the construction company's stock valued at $41,000 after purchasing an additional 3 shares in the last quarter. Smartleaf Asset Management LLC raised its holdings in shares of NVR by 75.0% in the fourth quarter. Smartleaf Asset Management LLC now owns 7 shares of the construction company's stock valued at $57,000 after acquiring an additional 3 shares in the last quarter. Wilmington Savings Fund Society FSB lifted its stake in NVR by 60.0% in the fourth quarter. Wilmington Savings Fund Society FSB now owns 8 shares of the construction company's stock worth $65,000 after acquiring an additional 3 shares during the period. Morse Asset Management Inc boosted its stake in shares of NVR by 1,200.0% during the fourth quarter. Morse Asset Management Inc now owns 13 shares of the construction company's stock valued at $106,000 after purchasing an additional 12 shares in the last quarter. Finally, Cullen Frost Bankers Inc. increased its holdings in shares of NVR by 122.2% in the 4th quarter. Cullen Frost Bankers Inc. now owns 20 shares of the construction company's stock valued at $164,000 after acquiring an additional 11 shares during the period. Institutional investors own 83.67% of the company's stock.

NVR Stock Performance

Shares of NVR stock opened at $7,167.61 on Thursday. The business has a fifty day moving average of $7,177.24 and a 200 day moving average of $7,917.30. NVR, Inc. has a 1 year low of $6,562.85 and a 1 year high of $9,964.77. The company has a debt-to-equity ratio of 0.22, a current ratio of 6.18 and a quick ratio of 3.69. The firm has a market capitalization of $20.96 billion, a price-to-earnings ratio of 14.12, a price-to-earnings-growth ratio of 2.39 and a beta of 1.02.

NVR (NYSE:NVR - Get Free Report) last released its quarterly earnings data on Tuesday, April 22nd. The construction company reported $94.83 EPS for the quarter, missing the consensus estimate of $107.87 by ($13.04). The business had revenue of $2.40 billion during the quarter, compared to analysts' expectations of $2.35 billion. NVR had a net margin of 16.34% and a return on equity of 39.67%. As a group, research analysts expect that NVR, Inc. will post 505.2 earnings per share for the current year.

NVR announced that its Board of Directors has approved a share repurchase program on Tuesday, May 6th that permits the company to buyback $750.00 million in outstanding shares. This buyback authorization permits the construction company to reacquire up to 3.6% of its shares through open market purchases. Shares buyback programs are generally a sign that the company's board of directors believes its shares are undervalued.

Analysts Set New Price Targets

NVR has been the subject of a number of analyst reports. JPMorgan Chase & Co. decreased their price objective on NVR from $9,245.00 to $8,570.00 and set a "neutral" rating for the company in a research note on Wednesday, January 29th. UBS Group decreased their target price on shares of NVR from $8,900.00 to $7,900.00 and set a "neutral" rating for the company in a research report on Wednesday, April 23rd. Four investment analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $9,023.33.

Check Out Our Latest Research Report on NVR

NVR Company Profile

(

Free Report)

NVR, Inc operates as a homebuilder in the United States. The company operates through, Homebuilding and Mortgage Banking segments. It engages in the construction and sale of single-family detached homes, townhomes, and condominium buildings under the Ryan Homes, NVHomes, and Heartland Homes names. The company markets its Ryan Homes products to first-time and first-time move-up buyers; and NVHomes and Heartland Homes products to move-up and luxury buyers.

Featured Stories

Want to see what other hedge funds are holding NVR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for NVR, Inc. (NYSE:NVR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NVR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVR wasn't on the list.

While NVR currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.