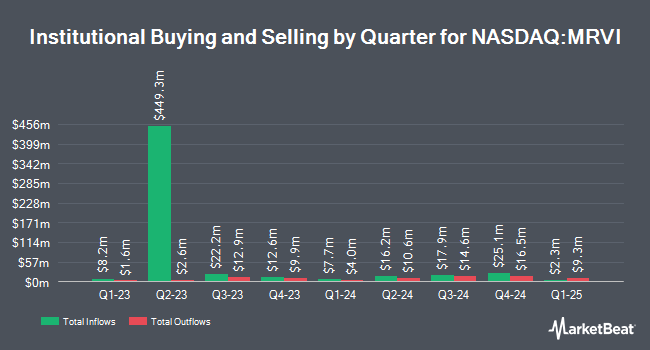

Voya Investment Management LLC increased its position in Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI - Free Report) by 337.6% in the fourth quarter, according to its most recent disclosure with the SEC. The institutional investor owned 346,723 shares of the company's stock after purchasing an additional 267,485 shares during the period. Voya Investment Management LLC owned 0.14% of Maravai LifeSciences worth $1,890,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently bought and sold shares of the company. SG Americas Securities LLC lifted its stake in Maravai LifeSciences by 7.3% during the fourth quarter. SG Americas Securities LLC now owns 33,046 shares of the company's stock valued at $180,000 after purchasing an additional 2,239 shares during the last quarter. China Universal Asset Management Co. Ltd. lifted its stake in Maravai LifeSciences by 10.5% in the fourth quarter. China Universal Asset Management Co. Ltd. now owns 30,076 shares of the company's stock valued at $164,000 after acquiring an additional 2,851 shares during the last quarter. Performa Ltd US LLC lifted its holdings in Maravai LifeSciences by 614.3% in the 4th quarter. Performa Ltd US LLC now owns 5,000 shares of the company's stock worth $27,000 after purchasing an additional 4,300 shares during the last quarter. FNY Investment Advisers LLC raised its position in shares of Maravai LifeSciences by 600.0% in the fourth quarter. FNY Investment Advisers LLC now owns 7,000 shares of the company's stock valued at $38,000 after purchasing an additional 6,000 shares during the period. Finally, Price T Rowe Associates Inc. MD raised its holdings in Maravai LifeSciences by 12.6% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 70,828 shares of the company's stock worth $387,000 after acquiring an additional 7,946 shares during the period. Institutional investors and hedge funds own 50.25% of the company's stock.

Maravai LifeSciences Stock Performance

Shares of NASDAQ:MRVI traded down $0.08 during midday trading on Friday, reaching $1.99. 551,437 shares of the company traded hands, compared to its average volume of 2,343,572. The company has a quick ratio of 9.94, a current ratio of 10.74 and a debt-to-equity ratio of 0.89. Maravai LifeSciences Holdings, Inc. has a 12 month low of $1.67 and a 12 month high of $11.56. The firm has a market capitalization of $506.13 million, a price-to-earnings ratio of -1.21 and a beta of 0.19. The firm's fifty day moving average price is $2.19 and its two-hundred day moving average price is $4.27.

Wall Street Analysts Forecast Growth

A number of analysts have commented on MRVI shares. Robert W. Baird downgraded Maravai LifeSciences from an "outperform" rating to a "neutral" rating and reduced their price objective for the stock from $9.00 to $3.00 in a research report on Wednesday, February 26th. Bank of America reduced their target price on shares of Maravai LifeSciences from $9.00 to $8.00 and set a "buy" rating on the stock in a research report on Monday, March 3rd. Stifel Nicolaus set a $5.00 price objective on Maravai LifeSciences in a report on Friday, March 21st. Morgan Stanley decreased their price target on shares of Maravai LifeSciences from $7.00 to $5.00 and set an "equal weight" rating for the company in a report on Tuesday, March 25th. Finally, UBS Group decreased their price objective on Maravai LifeSciences from $8.00 to $2.50 and set a "neutral" rating for the company in a report on Friday, March 21st. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating and three have given a buy rating to the company. According to MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $6.34.

Check Out Our Latest Stock Analysis on MRVI

Maravai LifeSciences Profile

(

Free Report)

Maravai LifeSciences Holdings, Inc, a life sciences company, provides products to enable the development of drug therapies, diagnostics, novel vaccines, and support research on human diseases worldwide. The company's products address the key phases of biopharmaceutical development and include nucleic acids for diagnostic and therapeutic applications, antibody-based products to detect impurities during the production of biopharmaceutical products, and products to detect the expression of proteins in tissues of various species.

See Also

Before you consider Maravai LifeSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maravai LifeSciences wasn't on the list.

While Maravai LifeSciences currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.