Ameriprise Financial Inc. grew its holdings in MarketAxess Holdings Inc. (NASDAQ:MKTX - Free Report) by 26.6% during the fourth quarter, according to the company in its most recent filing with the SEC. The fund owned 161,490 shares of the financial services provider's stock after acquiring an additional 33,949 shares during the quarter. Ameriprise Financial Inc. owned about 0.43% of MarketAxess worth $36,503,000 at the end of the most recent reporting period.

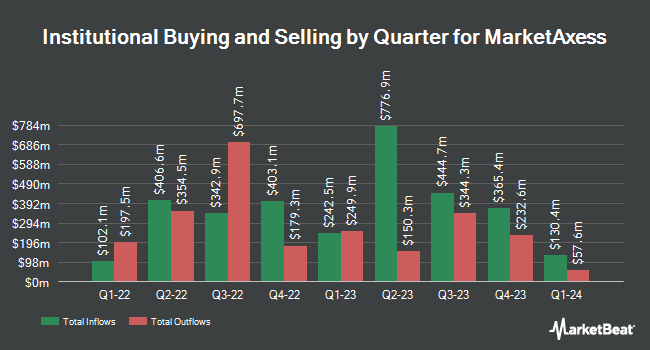

Several other hedge funds and other institutional investors have also made changes to their positions in the business. Barclays PLC raised its holdings in MarketAxess by 16.5% during the third quarter. Barclays PLC now owns 140,760 shares of the financial services provider's stock worth $36,063,000 after purchasing an additional 19,962 shares in the last quarter. Franklin Resources Inc. raised its stake in MarketAxess by 242.7% during the 3rd quarter. Franklin Resources Inc. now owns 8,215 shares of the financial services provider's stock worth $2,337,000 after acquiring an additional 5,818 shares in the last quarter. Principal Financial Group Inc. lifted its position in MarketAxess by 22.9% in the third quarter. Principal Financial Group Inc. now owns 55,679 shares of the financial services provider's stock valued at $14,265,000 after acquiring an additional 10,361 shares during the last quarter. Wealth Enhancement Advisory Services LLC lifted its position in MarketAxess by 13.6% in the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 1,126 shares of the financial services provider's stock valued at $255,000 after acquiring an additional 135 shares during the last quarter. Finally, Czech National Bank boosted its stake in MarketAxess by 6.3% in the fourth quarter. Czech National Bank now owns 8,175 shares of the financial services provider's stock valued at $1,848,000 after acquiring an additional 485 shares in the last quarter. Institutional investors and hedge funds own 99.01% of the company's stock.

Wall Street Analysts Forecast Growth

MKTX has been the subject of several research reports. Piper Sandler reduced their target price on MarketAxess from $213.00 to $202.00 and set a "neutral" rating for the company in a report on Thursday, May 8th. Bank of America raised their price objective on shares of MarketAxess from $189.00 to $191.00 and gave the stock an "underperform" rating in a research report on Wednesday, April 2nd. The Goldman Sachs Group reduced their target price on shares of MarketAxess from $235.00 to $210.00 and set a "neutral" rating for the company in a report on Monday, February 10th. Barclays increased their target price on shares of MarketAxess from $232.00 to $240.00 and gave the stock an "equal weight" rating in a research note on Thursday, May 8th. Finally, UBS Group dropped their price target on MarketAxess from $305.00 to $295.00 and set a "buy" rating on the stock in a research report on Monday, April 7th. One analyst has rated the stock with a sell rating, six have issued a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $241.78.

Read Our Latest Stock Report on MarketAxess

MarketAxess Stock Performance

MarketAxess stock traded up $2.48 during trading on Friday, reaching $216.01. 530,864 shares of the company's stock were exchanged, compared to its average volume of 497,630. MarketAxess Holdings Inc. has a 52-week low of $186.84 and a 52-week high of $296.68. The firm has a market cap of $8.10 billion, a price-to-earnings ratio of 29.71, a PEG ratio of 3.89 and a beta of 0.89. The company's 50-day moving average is $217.23 and its two-hundred day moving average is $226.40.

MarketAxess (NASDAQ:MKTX - Get Free Report) last issued its earnings results on Wednesday, May 7th. The financial services provider reported $1.87 earnings per share for the quarter, topping the consensus estimate of $1.82 by $0.05. The company had revenue of $208.58 million during the quarter, compared to the consensus estimate of $211.81 million. MarketAxess had a return on equity of 20.23% and a net margin of 33.56%. The company's revenue was down .8% compared to the same quarter last year. During the same quarter in the prior year, the business earned $1.92 earnings per share. Analysts anticipate that MarketAxess Holdings Inc. will post 7.79 EPS for the current year.

MarketAxess Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, June 4th. Stockholders of record on Wednesday, May 21st will be given a dividend of $0.76 per share. The ex-dividend date of this dividend is Wednesday, May 21st. This represents a $3.04 dividend on an annualized basis and a dividend yield of 1.41%. MarketAxess's payout ratio is currently 52.87%.

About MarketAxess

(

Free Report)

MarketAxess Holdings Inc, together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. The company offers trading technology that provides liquidity access in U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, eurobonds, municipal bonds, U.S.

Featured Articles

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.