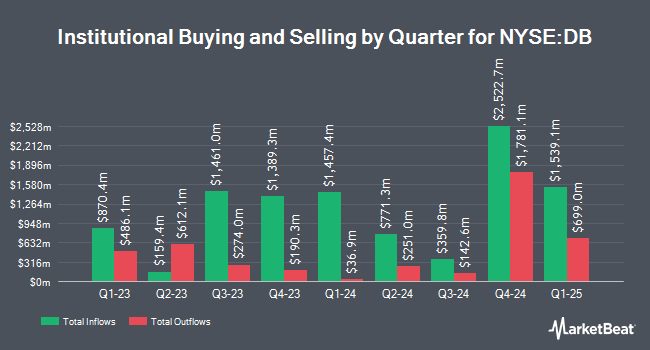

Mercer Global Advisors Inc. ADV trimmed its position in shares of Deutsche Bank Aktiengesellschaft (NYSE:DB - Free Report) by 11.7% during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 204,313 shares of the bank's stock after selling 26,949 shares during the period. Mercer Global Advisors Inc. ADV's holdings in Deutsche Bank Aktiengesellschaft were worth $3,484,000 as of its most recent SEC filing.

A number of other hedge funds also recently bought and sold shares of the company. Versant Capital Management Inc purchased a new position in shares of Deutsche Bank Aktiengesellschaft in the fourth quarter worth about $26,000. Wilmington Savings Fund Society FSB purchased a new position in Deutsche Bank Aktiengesellschaft in the 3rd quarter worth approximately $43,000. Jones Financial Companies Lllp boosted its stake in shares of Deutsche Bank Aktiengesellschaft by 1,270.5% during the fourth quarter. Jones Financial Companies Lllp now owns 4,043 shares of the bank's stock valued at $69,000 after purchasing an additional 3,748 shares during the period. Activest Wealth Management bought a new position in shares of Deutsche Bank Aktiengesellschaft in the fourth quarter worth approximately $86,000. Finally, Smartleaf Asset Management LLC increased its stake in shares of Deutsche Bank Aktiengesellschaft by 218.4% in the fourth quarter. Smartleaf Asset Management LLC now owns 7,278 shares of the bank's stock worth $125,000 after buying an additional 4,992 shares during the period. Institutional investors own 27.90% of the company's stock.

Deutsche Bank Aktiengesellschaft Stock Up 2.3 %

DB stock traded up $0.62 during midday trading on Friday, hitting $27.33. The stock had a trading volume of 1,874,756 shares, compared to its average volume of 2,311,867. The company has a debt-to-equity ratio of 1.45, a current ratio of 0.74 and a quick ratio of 0.78. The firm has a market cap of $54.44 billion, a price-to-earnings ratio of 19.66 and a beta of 1.00. The business has a 50-day moving average of $24.07 and a two-hundred day moving average of $20.23. Deutsche Bank Aktiengesellschaft has a 52-week low of $13.70 and a 52-week high of $27.38.

Deutsche Bank Aktiengesellschaft (NYSE:DB - Get Free Report) last issued its quarterly earnings results on Tuesday, April 29th. The bank reported $1.04 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.85 by $0.19. The company had revenue of $8.97 billion during the quarter, compared to analyst estimates of $7.95 billion. Deutsche Bank Aktiengesellschaft had a net margin of 4.66% and a return on equity of 3.90%. As a group, equities research analysts forecast that Deutsche Bank Aktiengesellschaft will post 2.93 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

DB has been the topic of a number of recent analyst reports. Citigroup reissued a "neutral" rating on shares of Deutsche Bank Aktiengesellschaft in a report on Monday, February 3rd. Morgan Stanley restated an "overweight" rating on shares of Deutsche Bank Aktiengesellschaft in a report on Friday, March 7th. Royal Bank of Canada restated an "outperform" rating on shares of Deutsche Bank Aktiengesellschaft in a report on Monday, March 24th. StockNews.com raised shares of Deutsche Bank Aktiengesellschaft from a "hold" rating to a "buy" rating in a research report on Wednesday, February 5th. Finally, The Goldman Sachs Group upgraded shares of Deutsche Bank Aktiengesellschaft to a "strong-buy" rating in a report on Thursday, January 30th. Two investment analysts have rated the stock with a hold rating, four have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy".

View Our Latest Research Report on Deutsche Bank Aktiengesellschaft

Deutsche Bank Aktiengesellschaft Company Profile

(

Free Report)

Deutsche Bank Aktiengesellschaft, a stock corporation, provides corporate and investment banking, and asset management products and services to private individuals, corporate entities, and institutional clients in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Featured Articles

Before you consider Deutsche Bank Aktiengesellschaft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deutsche Bank Aktiengesellschaft wasn't on the list.

While Deutsche Bank Aktiengesellschaft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.