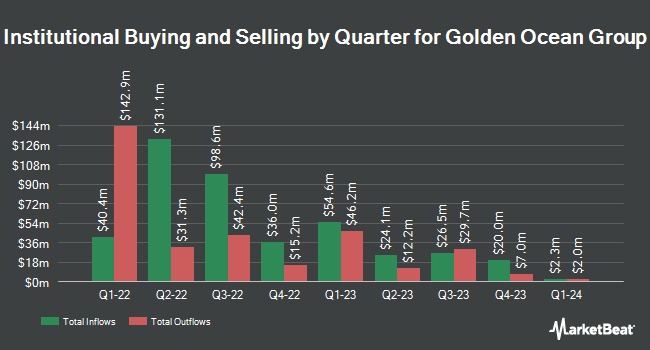

Mirabella Financial Services LLP boosted its holdings in shares of Golden Ocean Group Limited (NASDAQ:GOGL - Free Report) by 114.2% during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,499,244 shares of the shipping company's stock after acquiring an additional 799,244 shares during the period. Golden Ocean Group comprises about 1.2% of Mirabella Financial Services LLP's portfolio, making the stock its 18th largest position. Mirabella Financial Services LLP owned approximately 0.75% of Golden Ocean Group worth $13,222,000 at the end of the most recent quarter.

Other institutional investors have also added to or reduced their stakes in the company. FMR LLC lifted its position in shares of Golden Ocean Group by 146.8% in the 3rd quarter. FMR LLC now owns 12,210 shares of the shipping company's stock worth $163,000 after purchasing an additional 7,263 shares during the period. JPMorgan Chase & Co. lifted its holdings in Golden Ocean Group by 31.7% during the third quarter. JPMorgan Chase & Co. now owns 444,453 shares of the shipping company's stock worth $5,947,000 after buying an additional 106,966 shares during the period. Harbour Capital Advisors LLC boosted its position in Golden Ocean Group by 70.6% during the 4th quarter. Harbour Capital Advisors LLC now owns 41,515 shares of the shipping company's stock valued at $378,000 after acquiring an additional 17,185 shares in the last quarter. Assenagon Asset Management S.A. increased its holdings in shares of Golden Ocean Group by 196.5% in the 4th quarter. Assenagon Asset Management S.A. now owns 961,367 shares of the shipping company's stock valued at $8,614,000 after acquiring an additional 637,103 shares during the period. Finally, Dakota Wealth Management purchased a new position in shares of Golden Ocean Group in the 4th quarter valued at $770,000. Hedge funds and other institutional investors own 22.00% of the company's stock.

Golden Ocean Group Stock Down 0.3 %

Shares of NASDAQ GOGL traded down $0.03 during trading hours on Friday, hitting $7.72. 1,790,007 shares of the stock were exchanged, compared to its average volume of 2,226,511. Golden Ocean Group Limited has a 12 month low of $6.27 and a 12 month high of $15.77. The firm has a fifty day moving average price of $8.08 and a 200-day moving average price of $9.36. The company has a quick ratio of 1.22, a current ratio of 1.22 and a debt-to-equity ratio of 0.65. The company has a market cap of $1.54 billion, a PE ratio of 6.38 and a beta of 1.10.

Golden Ocean Group Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, March 21st. Stockholders of record on Tuesday, March 11th were given a dividend of $0.15 per share. This represents a $0.60 dividend on an annualized basis and a dividend yield of 7.78%. The ex-dividend date of this dividend was Tuesday, March 11th. Golden Ocean Group's payout ratio is presently 53.57%.

Analysts Set New Price Targets

Separately, Jefferies Financial Group dropped their price objective on Golden Ocean Group from $10.00 to $8.00 and set a "hold" rating on the stock in a research report on Wednesday.

Get Our Latest Analysis on GOGL

Golden Ocean Group Company Profile

(

Free Report)

Golden Ocean Group Limited, a shipping company, owns and operates a fleet of dry bulk vessels worldwide. The company's dry bulk vessels comprise Newcastlemax, Capesize, and Panamax vessels operating in the spot and time charter markets. It also transports a range of bulk commodities, including ores, coal, grains, and fertilizers.

See Also

Before you consider Golden Ocean Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golden Ocean Group wasn't on the list.

While Golden Ocean Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.