Core Scientific (NASDAQ:CORZ - Free Report) had its price objective boosted by Needham & Company LLC from $16.00 to $18.00 in a research note issued to investors on Tuesday,Benzinga reports. They currently have a buy rating on the stock.

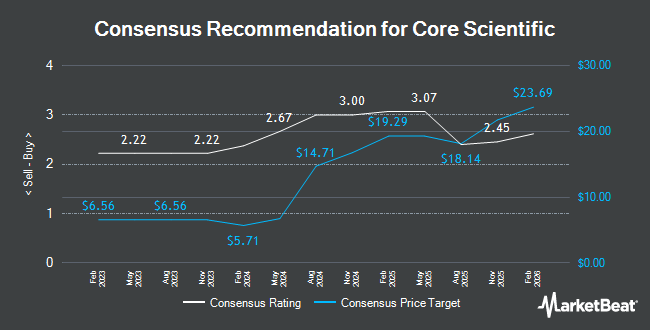

A number of other equities research analysts have also recently weighed in on CORZ. HC Wainwright restated a "buy" rating and issued a $17.00 price target on shares of Core Scientific in a research note on Tuesday, March 11th. Canaccord Genuity Group reissued a "buy" rating and issued a $17.00 price target on shares of Core Scientific in a report on Friday, May 9th. Cantor Fitzgerald reduced their price objective on Core Scientific from $24.00 to $21.00 and set an "overweight" rating for the company in a report on Thursday, February 27th. Compass Point dropped their price target on Core Scientific from $26.00 to $20.00 and set a "buy" rating for the company in a report on Tuesday, February 25th. Finally, JMP Securities initiated coverage on Core Scientific in a report on Thursday, May 22nd. They issued a "market outperform" rating and a $15.00 price objective on the stock. Eighteen equities research analysts have rated the stock with a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Core Scientific presently has a consensus rating of "Buy" and a consensus price target of $18.44.

Check Out Our Latest Research Report on CORZ

Core Scientific Price Performance

CORZ stock traded up $0.06 during mid-day trading on Tuesday, reaching $12.77. The company had a trading volume of 8,853,768 shares, compared to its average volume of 13,113,974. Core Scientific has a 52 week low of $6.20 and a 52 week high of $18.63. The company has a market capitalization of $3.80 billion, a price-to-earnings ratio of -2.36 and a beta of 6.30. The stock has a 50 day simple moving average of $9.06 and a two-hundred day simple moving average of $11.43.

Core Scientific (NASDAQ:CORZ - Get Free Report) last posted its quarterly earnings results on Wednesday, May 7th. The company reported ($0.10) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.12) by $0.02. The firm had revenue of $79.53 million for the quarter, compared to the consensus estimate of $92.04 million. During the same period last year, the company posted $0.78 earnings per share. The business's revenue was down 55.6% compared to the same quarter last year. On average, equities analysts predict that Core Scientific will post 0.52 EPS for the current year.

Insider Transactions at Core Scientific

In related news, Director Yadin Rozov acquired 110,000 shares of the company's stock in a transaction that occurred on Wednesday, May 28th. The stock was acquired at an average price of $10.87 per share, with a total value of $1,195,700.00. Following the purchase, the director now directly owns 475,687 shares in the company, valued at approximately $5,170,717.69. This trade represents a 30.08% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. Also, insider Todd M. Duchene sold 50,000 shares of the firm's stock in a transaction that occurred on Wednesday, June 4th. The shares were sold at an average price of $12.31, for a total transaction of $615,500.00. Following the completion of the sale, the insider now owns 2,050,102 shares in the company, valued at $25,236,755.62. This represents a 2.38% decrease in their position. The disclosure for this sale can be found here. 1.40% of the stock is owned by insiders.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. Wellington Shields & Co. LLC acquired a new position in Core Scientific in the 4th quarter worth about $26,000. First Horizon Advisors Inc. bought a new stake in shares of Core Scientific during the fourth quarter worth about $34,000. State of Wyoming acquired a new position in shares of Core Scientific in the first quarter valued at approximately $34,000. Emerald Mutual Fund Advisers Trust bought a new position in Core Scientific in the 1st quarter valued at approximately $38,000. Finally, Newbridge Financial Services Group Inc. bought a new position in Core Scientific in the 4th quarter valued at approximately $42,000.

Core Scientific Company Profile

(

Get Free Report)

Core Scientific, Inc provides digital asset mining services in North America. It operates through two segments, Mining and Hosting. The company offers blockchain infrastructure, software solutions, and services; and operates data center mining facilities. It also mines digital assets for its own account; and provides hosting services for other large bitcoin miners, which include deployment, monitoring, trouble shooting, optimization, and maintenance of its customers' digital asset mining equipment.

Featured Stories

Before you consider Core Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Scientific wasn't on the list.

While Core Scientific currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for June 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.