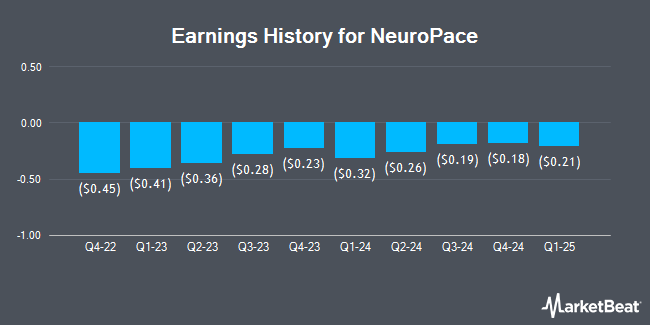

NeuroPace (NASDAQ:NPCE - Get Free Report) is projected to announce its Q1 2025 earnings results before the market opens on Wednesday, May 14th. Analysts expect the company to announce earnings of ($0.26) per share and revenue of $21.85 million for the quarter.

NeuroPace (NASDAQ:NPCE - Get Free Report) last announced its quarterly earnings data on Tuesday, March 4th. The company reported ($0.18) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.25) by $0.07. The business had revenue of $21.47 million during the quarter, compared to the consensus estimate of $21.14 million. NeuroPace had a negative net margin of 36.74% and a negative return on equity of 205.41%. On average, analysts expect NeuroPace to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

NeuroPace Trading Up 1.4 %

NPCE opened at $11.69 on Wednesday. NeuroPace has a one year low of $5.45 and a one year high of $15.11. The company has a debt-to-equity ratio of 6.03, a quick ratio of 4.77 and a current ratio of 5.59. The stock has a market cap of $382.88 million, a price-to-earnings ratio of -11.69 and a beta of 2.04. The stock's 50 day moving average price is $11.51 and its 200-day moving average price is $11.15.

Analyst Ratings Changes

A number of analysts have weighed in on the company. Wells Fargo & Company increased their target price on NeuroPace from $13.00 to $17.00 and gave the stock an "overweight" rating in a research note on Thursday, January 30th. UBS Group began coverage on shares of NeuroPace in a research note on Tuesday, January 21st. They issued a "buy" rating and a $17.00 price target on the stock. Finally, Cantor Fitzgerald boosted their price objective on shares of NeuroPace from $19.00 to $20.00 and gave the company an "overweight" rating in a research report on Wednesday, March 5th. One equities research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat, NeuroPace presently has a consensus rating of "Moderate Buy" and a consensus price target of $15.20.

Check Out Our Latest Stock Report on NPCE

Insider Activity

In other NeuroPace news, insider Martha Morrell sold 78,334 shares of the firm's stock in a transaction that occurred on Friday, February 21st. The shares were sold at an average price of $13.72, for a total value of $1,074,742.48. Following the completion of the sale, the insider now directly owns 81,993 shares in the company, valued at $1,124,943.96. This trade represents a 48.86 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, major shareholder Ltd. Kck sold 5,270,845 shares of the firm's stock in a transaction on Thursday, February 20th. The stock was sold at an average price of $9.40, for a total value of $49,545,943.00. The disclosure for this sale can be found here. Insiders own 22.20% of the company's stock.

About NeuroPace

(

Get Free Report)

NeuroPace, Inc operates as a medical device company in the United States. The company develops RNS system, a brain-responsive neuromodulation system that delivers personalized, real-time treatment at the seizure source for treating medically refractory focal epilepsy. It also records continuous brain activity data and enables clinicians to monitor patients in person and remotely.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NeuroPace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NeuroPace wasn't on the list.

While NeuroPace currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.