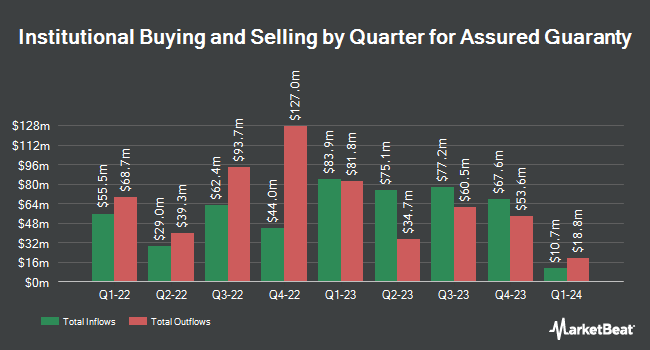

Norges Bank purchased a new stake in Assured Guaranty Ltd. (NYSE:AGO - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 560,456 shares of the financial services provider's stock, valued at approximately $50,447,000. Norges Bank owned approximately 1.10% of Assured Guaranty at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also recently made changes to their positions in the stock. JPMorgan Chase & Co. boosted its stake in Assured Guaranty by 10.3% during the fourth quarter. JPMorgan Chase & Co. now owns 155,526 shares of the financial services provider's stock worth $13,999,000 after buying an additional 14,565 shares during the last quarter. WINTON GROUP Ltd acquired a new position in shares of Assured Guaranty during the 4th quarter valued at about $5,799,000. LPL Financial LLC boosted its position in shares of Assured Guaranty by 0.8% during the 4th quarter. LPL Financial LLC now owns 36,455 shares of the financial services provider's stock valued at $3,281,000 after acquiring an additional 297 shares during the last quarter. Fox Run Management L.L.C. grew its holdings in shares of Assured Guaranty by 75.2% in the fourth quarter. Fox Run Management L.L.C. now owns 10,008 shares of the financial services provider's stock valued at $901,000 after purchasing an additional 4,295 shares during the period. Finally, KLP Kapitalforvaltning AS acquired a new stake in Assured Guaranty during the fourth quarter worth about $1,980,000. Institutional investors and hedge funds own 92.22% of the company's stock.

Assured Guaranty Trading Up 7.0 %

NYSE:AGO traded up $5.38 on Wednesday, hitting $82.69. The stock had a trading volume of 553,098 shares, compared to its average volume of 358,472. The company has a fifty day moving average price of $88.14 and a two-hundred day moving average price of $87.94. Assured Guaranty Ltd. has a 1-year low of $72.57 and a 1-year high of $96.50. The company has a quick ratio of 0.91, a current ratio of 0.91 and a debt-to-equity ratio of 0.29. The stock has a market cap of $4.13 billion, a price-to-earnings ratio of 6.43 and a beta of 0.84.

Assured Guaranty (NYSE:AGO - Get Free Report) last released its quarterly earnings data on Thursday, February 27th. The financial services provider reported $1.27 EPS for the quarter, missing analysts' consensus estimates of $1.34 by ($0.07). The business had revenue of $199.00 million during the quarter, compared to analyst estimates of $199.56 million. Assured Guaranty had a net margin of 70.37% and a return on equity of 11.58%. Equities research analysts expect that Assured Guaranty Ltd. will post 7.3 earnings per share for the current fiscal year.

Assured Guaranty Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, March 19th. Investors of record on Wednesday, March 5th were given a dividend of $0.34 per share. This represents a $1.36 dividend on an annualized basis and a dividend yield of 1.64%. This is an increase from Assured Guaranty's previous quarterly dividend of $0.31. The ex-dividend date of this dividend was Wednesday, March 5th. Assured Guaranty's dividend payout ratio (DPR) is presently 19.94%.

Assured Guaranty Profile

(

Free Report)

Assured Guaranty Ltd., together with its subsidiaries, provides credit protection products to public finance, infrastructure, and structured finance markets in the United States and internationally. It operates through two segments: Insurance and Asset Management. The company offers financial guaranty insurance that protects holders of debt instruments and other monetary obligations from defaults in scheduled payments.

Further Reading

Before you consider Assured Guaranty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Assured Guaranty wasn't on the list.

While Assured Guaranty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.