Northern Trust Corp raised its position in shares of Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 9.6% in the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,861,845 shares of the technology infrastructure company's stock after acquiring an additional 163,472 shares during the period. Northern Trust Corp owned approximately 1.24% of Akamai Technologies worth $178,085,000 at the end of the most recent quarter.

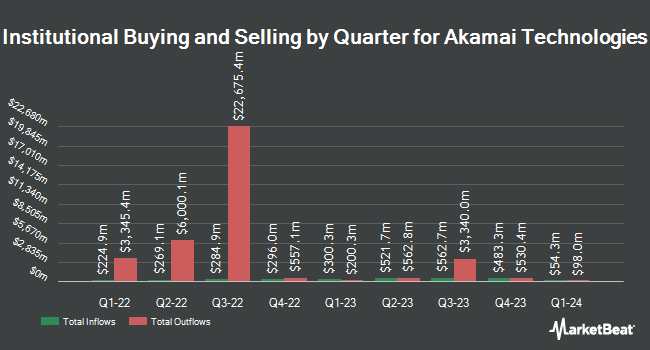

Several other institutional investors and hedge funds also recently made changes to their positions in the company. First Trust Advisors LP grew its holdings in Akamai Technologies by 15.6% in the 4th quarter. First Trust Advisors LP now owns 5,116,398 shares of the technology infrastructure company's stock valued at $489,383,000 after buying an additional 690,341 shares in the last quarter. Norges Bank acquired a new stake in Akamai Technologies in the 4th quarter worth about $477,454,000. Earnest Partners LLC boosted its holdings in Akamai Technologies by 2.7% in the 4th quarter. Earnest Partners LLC now owns 2,215,735 shares of the technology infrastructure company's stock valued at $211,935,000 after purchasing an additional 58,013 shares during the period. Nordea Investment Management AB grew its position in shares of Akamai Technologies by 6.9% during the 4th quarter. Nordea Investment Management AB now owns 2,140,257 shares of the technology infrastructure company's stock worth $205,743,000 after purchasing an additional 138,380 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. increased its holdings in shares of Akamai Technologies by 3.3% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 922,244 shares of the technology infrastructure company's stock worth $88,213,000 after purchasing an additional 29,888 shares during the period. Institutional investors and hedge funds own 94.28% of the company's stock.

Insider Buying and Selling

In related news, COO Adam Karon sold 6,431 shares of the stock in a transaction on Tuesday, March 4th. The stock was sold at an average price of $80.49, for a total value of $517,631.19. Following the completion of the sale, the chief operating officer now directly owns 14,239 shares of the company's stock, valued at approximately $1,146,097.11. This represents a 31.11 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CEO F Thomson Leighton bought 37,670 shares of Akamai Technologies stock in a transaction dated Thursday, February 27th. The stock was purchased at an average price of $79.58 per share, with a total value of $2,997,778.60. Following the purchase, the chief executive officer now owns 137,342 shares in the company, valued at approximately $10,929,676.36. This represents a 37.79 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders have sold a total of 31,394 shares of company stock valued at $2,653,043 over the last ninety days. 2.00% of the stock is owned by corporate insiders.

Akamai Technologies Trading Up 0.7 %

AKAM traded up $0.56 during midday trading on Monday, hitting $83.10. 1,576,338 shares of the company were exchanged, compared to its average volume of 1,934,125. The firm's 50 day moving average price is $78.66 and its 200-day moving average price is $90.05. Akamai Technologies, Inc. has a 1-year low of $67.51 and a 1-year high of $106.80. The firm has a market capitalization of $12.14 billion, a P/E ratio of 25.49, a P/E/G ratio of 2.74 and a beta of 0.82. The company has a quick ratio of 1.33, a current ratio of 1.23 and a debt-to-equity ratio of 0.49.

Akamai Technologies (NASDAQ:AKAM - Get Free Report) last announced its earnings results on Thursday, February 20th. The technology infrastructure company reported $1.19 earnings per share for the quarter, missing analysts' consensus estimates of $1.52 by ($0.33). The firm had revenue of $1.02 billion for the quarter, compared to the consensus estimate of $1.02 billion. Akamai Technologies had a return on equity of 14.35% and a net margin of 12.65%. As a group, equities analysts forecast that Akamai Technologies, Inc. will post 4.6 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of equities research analysts recently issued reports on the company. Craig Hallum downgraded Akamai Technologies from a "buy" rating to a "hold" rating and set a $90.00 price target on the stock. in a research report on Friday, February 21st. Raymond James dropped their price target on Akamai Technologies from $115.00 to $110.00 and set an "outperform" rating for the company in a research note on Friday, February 21st. Susquehanna reduced their price objective on shares of Akamai Technologies from $110.00 to $105.00 and set a "positive" rating on the stock in a research note on Friday, February 21st. Citigroup cut their price target on shares of Akamai Technologies from $102.00 to $95.00 and set a "neutral" rating for the company in a report on Monday, February 24th. Finally, Scotiabank lowered their price objective on shares of Akamai Technologies from $115.00 to $107.00 and set a "sector outperform" rating for the company in a research report on Friday, February 21st. One analyst has rated the stock with a sell rating, ten have assigned a hold rating, ten have issued a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, Akamai Technologies presently has an average rating of "Moderate Buy" and an average price target of $104.75.

Get Our Latest Research Report on Akamai Technologies

Akamai Technologies Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Recommended Stories

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report