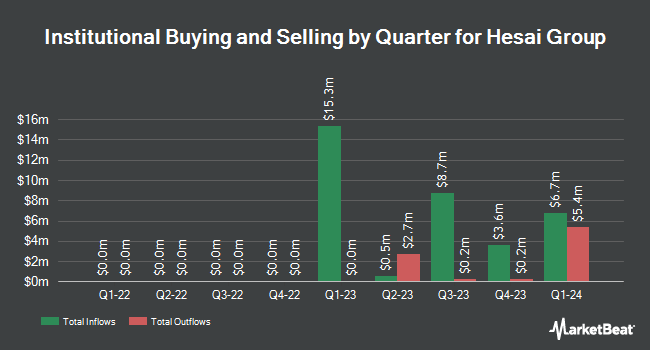

Numerai GP LLC bought a new stake in Hesai Group (NASDAQ:HSAI - Free Report) in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 28,553 shares of the company's stock, valued at approximately $395,000.

Other large investors also recently added to or reduced their stakes in the company. Millennium Management LLC bought a new stake in shares of Hesai Group during the 4th quarter worth about $14,736,000. Lightspeed Management Company L.L.C. bought a new stake in Hesai Group during the fourth quarter worth approximately $110,560,000. D. E. Shaw & Co. Inc. acquired a new position in Hesai Group during the fourth quarter valued at approximately $9,265,000. Diker Management LLC acquired a new position in Hesai Group during the fourth quarter valued at approximately $1,241,000. Finally, Bank of America Corp DE raised its position in shares of Hesai Group by 2,015.6% in the fourth quarter. Bank of America Corp DE now owns 166,458 shares of the company's stock valued at $2,300,000 after purchasing an additional 158,590 shares during the period. 48.53% of the stock is owned by institutional investors.

Hesai Group Stock Performance

HSAI traded up $2.03 during midday trading on Wednesday, reaching $21.60. The company's stock had a trading volume of 4,564,301 shares, compared to its average volume of 2,632,510. The company has a current ratio of 3.08, a quick ratio of 2.65 and a debt-to-equity ratio of 0.08. The company has a fifty day simple moving average of $16.19 and a 200 day simple moving average of $14.06. The stock has a market cap of $2.83 billion, a P/E ratio of -49.12, a PEG ratio of 1.44 and a beta of 1.18. Hesai Group has a twelve month low of $3.52 and a twelve month high of $24.18.

Analyst Ratings Changes

HSAI has been the subject of several recent analyst reports. Daiwa America raised shares of Hesai Group to a "strong-buy" rating in a report on Tuesday, March 11th. Daiwa Capital Markets initiated coverage on shares of Hesai Group in a research report on Tuesday, March 11th. They set a "buy" rating and a $35.00 target price for the company.

Read Our Latest Research Report on Hesai Group

Hesai Group Profile

(

Free Report)

Hesai Group, through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR). Its LiDAR products are used in passenger and commercial vehicles with advanced driver assistance systems; autonomous passenger and freight mobility services; and other applications, such as delivery robots, street sweeping robots, and logistics robots in restricted areas.

See Also

Before you consider Hesai Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hesai Group wasn't on the list.

While Hesai Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.