OMERS ADMINISTRATION Corp decreased its stake in Pure Storage, Inc. (NYSE:PSTG - Free Report) by 35.6% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 24,292 shares of the technology company's stock after selling 13,408 shares during the period. OMERS ADMINISTRATION Corp's holdings in Pure Storage were worth $1,492,000 at the end of the most recent reporting period.

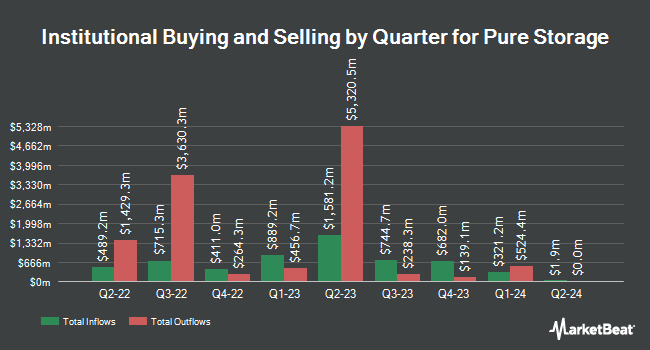

Several other large investors have also modified their holdings of PSTG. Sugar Maple Asset Management LLC purchased a new stake in Pure Storage in the fourth quarter valued at $29,000. Compass Financial Services Inc purchased a new stake in shares of Pure Storage in the 4th quarter valued at about $29,000. Crowley Wealth Management Inc. acquired a new stake in shares of Pure Storage in the 4th quarter valued at about $31,000. Berbice Capital Management LLC acquired a new stake in shares of Pure Storage in the 4th quarter valued at about $37,000. Finally, Financial Life Planners purchased a new position in Pure Storage during the 4th quarter worth approximately $44,000. Institutional investors and hedge funds own 83.42% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently commented on the stock. StockNews.com cut shares of Pure Storage from a "buy" rating to a "hold" rating in a report on Thursday, February 27th. Needham & Company LLC restated a "buy" rating and set a $75.00 price target on shares of Pure Storage in a research note on Thursday, February 27th. UBS Group lifted their price objective on shares of Pure Storage from $47.00 to $50.00 and gave the company a "sell" rating in a research report on Thursday, February 27th. Piper Sandler cut their price objective on shares of Pure Storage from $76.00 to $53.00 and set an "overweight" rating for the company in a research report on Tuesday, April 8th. Finally, Evercore ISI dropped their price target on shares of Pure Storage from $75.00 to $60.00 and set an "outperform" rating on the stock in a research note on Monday, April 28th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and fifteen have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $70.70.

Check Out Our Latest Research Report on Pure Storage

Insider Transactions at Pure Storage

In related news, insider John Colgrove sold 100,000 shares of the stock in a transaction on Monday, May 12th. The stock was sold at an average price of $52.01, for a total transaction of $5,201,000.00. Following the sale, the insider now owns 801,959 shares of the company's stock, valued at $41,709,887.59. This trade represents a 11.09% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CRO Dan Fitzsimons sold 6,977 shares of the business's stock in a transaction dated Monday, April 21st. The shares were sold at an average price of $40.91, for a total transaction of $285,429.07. Following the completion of the transaction, the executive now directly owns 90,223 shares of the company's stock, valued at $3,691,022.93. The trade was a 7.18% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 107,849 shares of company stock valued at $5,531,346 in the last ninety days. Corporate insiders own 5.60% of the company's stock.

Pure Storage Price Performance

PSTG traded down $0.28 during midday trading on Monday, reaching $56.28. 2,147,964 shares of the company's stock were exchanged, compared to its average volume of 3,091,171. Pure Storage, Inc. has a 1-year low of $34.51 and a 1-year high of $73.67. The stock has a market capitalization of $18.35 billion, a PE ratio of 148.11, a P/E/G ratio of 5.12 and a beta of 1.05. The business's 50-day moving average price is $46.48 and its 200 day moving average price is $55.74.

About Pure Storage

(

Free Report)

Pure Storage, Inc engages in the provision of data storage and management technologies, products, and services in the United States and internationally. Its Purity software is shared across its products and provides enterprise-class data services, such as always-on data reduction, data protection, and encryption, as well as storage protocols, including block, file, and object.

Further Reading

Before you consider Pure Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pure Storage wasn't on the list.

While Pure Storage currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.