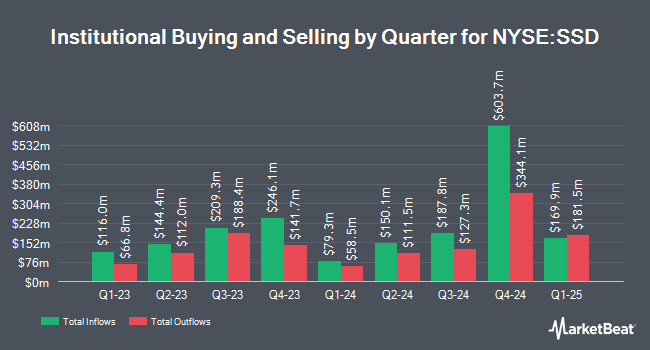

Ontario Teachers Pension Plan Board bought a new stake in Simpson Manufacturing Co., Inc. (NYSE:SSD - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 2,810 shares of the construction company's stock, valued at approximately $466,000.

A number of other institutional investors have also added to or reduced their stakes in SSD. Norges Bank bought a new stake in shares of Simpson Manufacturing in the 4th quarter worth approximately $73,758,000. Riverbridge Partners LLC acquired a new stake in Simpson Manufacturing during the fourth quarter worth $58,414,000. Raymond James Financial Inc. acquired a new position in shares of Simpson Manufacturing in the 4th quarter valued at $54,644,000. Wealthfront Advisers LLC acquired a new stake in shares of Simpson Manufacturing during the 4th quarter valued at about $15,603,000. Finally, Janney Montgomery Scott LLC increased its stake in Simpson Manufacturing by 1,473.8% in the fourth quarter. Janney Montgomery Scott LLC now owns 80,262 shares of the construction company's stock valued at $13,310,000 after acquiring an additional 75,162 shares during the period. 93.68% of the stock is owned by institutional investors and hedge funds.

Simpson Manufacturing Price Performance

Shares of NYSE SSD traded up $3.53 during mid-day trading on Wednesday, hitting $151.63. 33,030 shares of the stock were exchanged, compared to its average volume of 263,224. Simpson Manufacturing Co., Inc. has a twelve month low of $137.35 and a twelve month high of $197.82. The stock's fifty day simple moving average is $157.55 and its two-hundred day simple moving average is $170.10. The company has a debt-to-equity ratio of 0.20, a quick ratio of 1.59 and a current ratio of 3.21. The company has a market cap of $6.36 billion, a P/E ratio of 19.95 and a beta of 1.33.

Simpson Manufacturing (NYSE:SSD - Get Free Report) last issued its quarterly earnings data on Monday, February 10th. The construction company reported $1.31 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.27 by $0.04. Simpson Manufacturing had a return on equity of 18.00% and a net margin of 14.44%. As a group, analysts forecast that Simpson Manufacturing Co., Inc. will post 8.29 EPS for the current fiscal year.

Simpson Manufacturing Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, April 24th. Investors of record on Thursday, April 3rd will be given a dividend of $0.28 per share. The ex-dividend date of this dividend is Thursday, April 3rd. This represents a $1.12 annualized dividend and a yield of 0.74%. Simpson Manufacturing's dividend payout ratio (DPR) is 14.74%.

Insiders Place Their Bets

In other Simpson Manufacturing news, EVP Michael Andersen sold 1,000 shares of the company's stock in a transaction on Tuesday, February 25th. The stock was sold at an average price of $169.98, for a total transaction of $169,980.00. Following the transaction, the executive vice president now owns 8,810 shares of the company's stock, valued at approximately $1,497,523.80. This represents a 10.19 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 0.42% of the company's stock.

Analyst Ratings Changes

A number of brokerages have commented on SSD. DA Davidson cut their price target on shares of Simpson Manufacturing from $195.00 to $185.00 and set a "neutral" rating for the company in a research note on Tuesday, March 11th. Robert W. Baird lowered their price target on Simpson Manufacturing from $196.00 to $192.00 and set an "outperform" rating on the stock in a research report on Tuesday, February 11th.

Read Our Latest Stock Analysis on SSD

Simpson Manufacturing Profile

(

Free Report)

Simpson Manufacturing Co, Inc, through its subsidiaries, designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections. The company offers wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and pre-fabricated lateral systems for use in light-frame construction; and concrete construction products comprising adhesives, specialty chemicals, mechanical anchors, carbide drill bits, powder actuated tools, fiber-reinforced materials, and other repair products for use in concrete, masonry, and steel construction, as well as grouts, coatings, sealers, mortars, fiberglass and fiber-reinforced polymer systems, and asphalt products for use in concrete construction repair, and strengthening and protection products.

Read More

Before you consider Simpson Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simpson Manufacturing wasn't on the list.

While Simpson Manufacturing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.