Oxford Asset Management LLP acquired a new position in shares of ADMA Biologics, Inc. (NASDAQ:ADMA - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 13,420 shares of the biotechnology company's stock, valued at approximately $230,000.

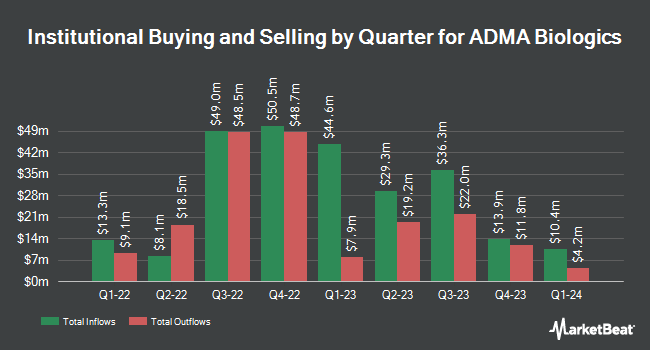

Several other institutional investors have also recently bought and sold shares of ADMA. Vanguard Group Inc. raised its holdings in shares of ADMA Biologics by 0.4% in the fourth quarter. Vanguard Group Inc. now owns 18,198,796 shares of the biotechnology company's stock valued at $312,109,000 after purchasing an additional 80,302 shares during the last quarter. Geode Capital Management LLC raised its holdings in shares of ADMA Biologics by 0.9% in the fourth quarter. Geode Capital Management LLC now owns 5,432,384 shares of the biotechnology company's stock valued at $93,187,000 after purchasing an additional 50,399 shares during the last quarter. Dimensional Fund Advisors LP raised its holdings in shares of ADMA Biologics by 16.0% in the fourth quarter. Dimensional Fund Advisors LP now owns 4,668,320 shares of the biotechnology company's stock valued at $80,065,000 after purchasing an additional 643,661 shares during the last quarter. Renaissance Technologies LLC raised its holdings in shares of ADMA Biologics by 2.8% in the fourth quarter. Renaissance Technologies LLC now owns 3,769,888 shares of the biotechnology company's stock valued at $64,654,000 after purchasing an additional 102,692 shares during the last quarter. Finally, Perpetual Ltd bought a new position in ADMA Biologics during the fourth quarter valued at about $62,300,000. Institutional investors and hedge funds own 75.68% of the company's stock.

ADMA Biologics Stock Performance

NASDAQ:ADMA traded down $0.53 on Thursday, reaching $23.27. 2,782,071 shares of the company's stock were exchanged, compared to its average volume of 3,689,110. The company has a debt-to-equity ratio of 0.48, a current ratio of 7.09 and a quick ratio of 3.26. The firm has a market cap of $5.53 billion, a price-to-earnings ratio of 83.11 and a beta of 0.53. ADMA Biologics, Inc. has a 52 week low of $6.60 and a 52 week high of $25.67. The stock has a fifty day simple moving average of $19.29 and a 200-day simple moving average of $18.40.

Analyst Upgrades and Downgrades

Separately, Cantor Fitzgerald restated an "overweight" rating and set a $25.00 price target on shares of ADMA Biologics in a research report on Tuesday, March 4th.

Check Out Our Latest Report on ADMA Biologics

ADMA Biologics Company Profile

(

Free Report)

ADMA Biologics, Inc, a biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally. The company offers BIVIGAM, an intravenous immune globulin (IVIG) product indicated for the treatment of primary humoral immunodeficiency (PI); ASCENIV, an IVIG product for the treatment of PI; and Nabi-HB for the treatment of acute exposure to blood containing Hepatitis B surface antigen and other listed exposures to Hepatitis B.

Further Reading

Before you consider ADMA Biologics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADMA Biologics wasn't on the list.

While ADMA Biologics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.