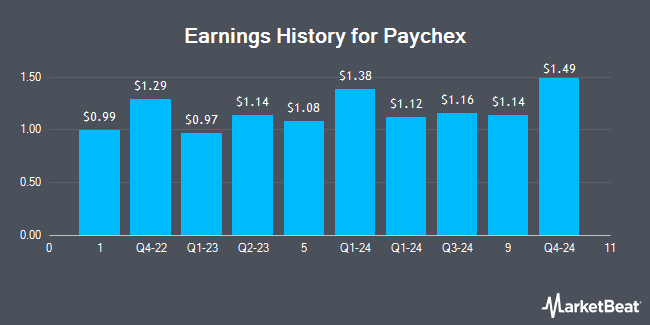

Paychex (NASDAQ:PAYX - Get Free Report) issued its quarterly earnings data on Wednesday. The business services provider reported $1.19 EPS for the quarter, hitting analysts' consensus estimates of $1.19, Zacks reports. The business had revenue of $1.43 billion for the quarter, compared to analysts' expectations of $1.38 billion. Paychex had a net margin of 31.99% and a return on equity of 45.30%. During the same quarter last year, the company earned $1.12 EPS. Paychex updated its FY 2026 guidance to EPS.

Paychex Price Performance

Shares of Paychex stock traded down $11.77 during trading hours on Wednesday, reaching $140.48. 3,976,664 shares of the company's stock were exchanged, compared to its average volume of 1,933,225. Paychex has a 1 year low of $115.40 and a 1 year high of $161.24. The company has a market capitalization of $50.60 billion, a P/E ratio of 29.20, a price-to-earnings-growth ratio of 3.30 and a beta of 0.92. The business has a fifty day moving average of $151.98 and a two-hundred day moving average of $147.82. The company has a quick ratio of 1.39, a current ratio of 1.39 and a debt-to-equity ratio of 0.19.

Paychex Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, May 29th. Shareholders of record on Monday, May 12th were issued a $1.08 dividend. The ex-dividend date was Monday, May 12th. This represents a $4.32 dividend on an annualized basis and a yield of 3.08%. This is a positive change from Paychex's previous quarterly dividend of $0.98. Paychex's dividend payout ratio (DPR) is presently 90.00%.

Insider Activity

In other Paychex news, Director Joseph M. Velli sold 3,650 shares of the business's stock in a transaction on Tuesday, April 15th. The stock was sold at an average price of $149.25, for a total transaction of $544,762.50. Following the transaction, the director now owns 78,455 shares of the company's stock, valued at approximately $11,709,408.75. The trade was a 4.45% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Company insiders own 11.40% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. Woodline Partners LP acquired a new stake in Paychex during the first quarter worth about $3,333,000. Brighton Jones LLC grew its stake in shares of Paychex by 26.3% in the 4th quarter. Brighton Jones LLC now owns 5,710 shares of the business services provider's stock valued at $801,000 after buying an additional 1,190 shares during the period. Finally, Bison Wealth LLC grew its stake in shares of Paychex by 3.0% in the 4th quarter. Bison Wealth LLC now owns 4,035 shares of the business services provider's stock valued at $566,000 after buying an additional 117 shares during the period. Hedge funds and other institutional investors own 83.47% of the company's stock.

Analyst Upgrades and Downgrades

PAYX has been the subject of several recent analyst reports. Royal Bank Of Canada set a $165.00 price target on Paychex and gave the company a "sector perform" rating in a research note on Tuesday. JPMorgan Chase & Co. raised their price objective on Paychex from $140.00 to $148.00 and gave the company an "underweight" rating in a report on Wednesday, June 18th. Jefferies Financial Group reaffirmed a "hold" rating on shares of Paychex in a research note on Friday, May 23rd. UBS Group increased their target price on Paychex from $152.00 to $155.00 and gave the company a "neutral" rating in a research report on Tuesday, March 4th. Finally, Cfra Research raised shares of Paychex to a "hold" rating in a report on Thursday, March 27th. Two equities research analysts have rated the stock with a sell rating and ten have given a hold rating to the company's stock. Based on data from MarketBeat, Paychex presently has a consensus rating of "Hold" and an average target price of $143.36.

Get Our Latest Stock Analysis on Paychex

Paychex Company Profile

(

Get Free Report)

Paychex, Inc, together with its subsidiaries, provides integrated human capital management solutions (HCM) for payroll, benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India. It offers payroll processing services; payroll tax administration services; employee payment services; and regulatory compliance services, such as new-hire reporting and garnishment processing.

Featured Stories

Before you consider Paychex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paychex wasn't on the list.

While Paychex currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.