Polar Capital Holdings Plc lessened its stake in shares of CRH plc (NYSE:CRH - Free Report) by 3.2% during the fourth quarter, according to the company in its most recent disclosure with the SEC. The fund owned 313,968 shares of the construction company's stock after selling 10,247 shares during the quarter. Polar Capital Holdings Plc's holdings in CRH were worth $29,048,000 as of its most recent SEC filing.

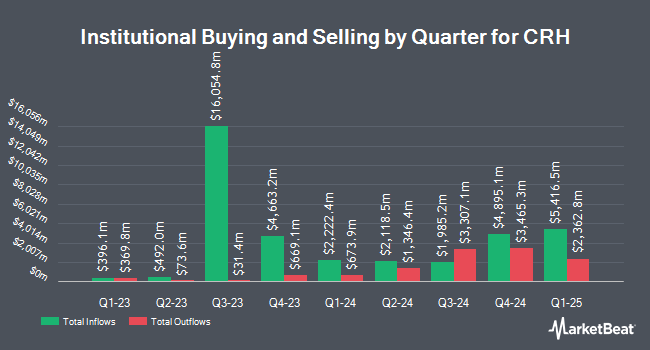

A number of other hedge funds and other institutional investors have also recently modified their holdings of the stock. Heck Capital Advisors LLC acquired a new position in shares of CRH during the fourth quarter worth $32,000. Brown Brothers Harriman & Co. lifted its holdings in shares of CRH by 214.3% during the fourth quarter. Brown Brothers Harriman & Co. now owns 352 shares of the construction company's stock worth $33,000 after purchasing an additional 240 shares during the period. Colonial Trust Co SC acquired a new position in shares of CRH during the fourth quarter worth $37,000. Whipplewood Advisors LLC acquired a new position in shares of CRH during the fourth quarter worth $38,000. Finally, Deseret Mutual Benefit Administrators raised its holdings in CRH by 87.7% during the 4th quarter. Deseret Mutual Benefit Administrators now owns 505 shares of the construction company's stock worth $47,000 after purchasing an additional 236 shares during the last quarter. Institutional investors own 62.50% of the company's stock.

CRH Trading Up 0.3%

Shares of NYSE CRH opened at $97.80 on Friday. The firm's 50-day moving average price is $91.42 and its 200-day moving average price is $96.29. CRH plc has a 1-year low of $71.18 and a 1-year high of $110.97. The firm has a market capitalization of $66.08 billion, a P/E ratio of 19.56, a P/E/G ratio of 1.15 and a beta of 1.33.

CRH (NYSE:CRH - Get Free Report) last announced its quarterly earnings data on Monday, May 5th. The construction company reported ($0.12) earnings per share for the quarter, missing the consensus estimate of ($0.06) by ($0.06). CRH had a net margin of 9.86% and a return on equity of 16.35%. The company had revenue of $6.76 billion for the quarter, compared to analyst estimates of $6.77 billion. Equities research analysts forecast that CRH plc will post 5.47 EPS for the current year.

CRH Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, June 25th. Stockholders of record on Friday, May 23rd will be given a dividend of $0.37 per share. This represents a $1.48 annualized dividend and a dividend yield of 1.51%. The ex-dividend date of this dividend is Friday, May 23rd. CRH's payout ratio is presently 23.52%.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on the stock. Morgan Stanley restated an "overweight" rating on shares of CRH in a report on Wednesday, May 7th. Berenberg Bank set a $120.00 target price on shares of CRH in a report on Friday, February 28th. JPMorgan Chase & Co. dropped their target price on shares of CRH from $118.00 to $114.00 and set an "overweight" rating on the stock in a report on Tuesday, March 11th. Sanford C. Bernstein assumed coverage on shares of CRH in a report on Tuesday. They issued an "outperform" rating and a $115.00 target price on the stock. Finally, Loop Capital assumed coverage on shares of CRH in a report on Wednesday, April 9th. They issued a "buy" rating and a $114.00 target price on the stock. One research analyst has rated the stock with a hold rating, twelve have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Buy" and an average target price of $112.58.

Check Out Our Latest Stock Report on CRH

CRH Company Profile

(

Free Report)

CRH plc, together with its subsidiaries, provides building materials solutions in Ireland and internationally. It operates through four segments: Americas Materials Solutions, Americas Building Solutions, Europe Materials Solutions, and Europe Building Solutions. The company provides solutions for the construction and maintenance of public infrastructure and commercial and residential buildings; and produces and sells aggregates, cement, readymixed concrete, and asphalt, as well as provides paving and construction services.

Featured Stories

Want to see what other hedge funds are holding CRH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CRH plc (NYSE:CRH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CRH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRH wasn't on the list.

While CRH currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.