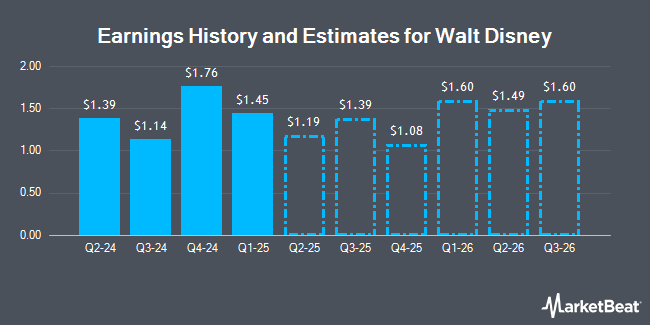

The Walt Disney Company (NYSE:DIS - Free Report) - Equities research analysts at Seaport Res Ptn raised their Q2 2026 earnings per share estimates for Walt Disney in a report released on Friday, June 27th. Seaport Res Ptn analyst D. Joyce now anticipates that the entertainment giant will earn $1.67 per share for the quarter, up from their prior estimate of $1.56. The consensus estimate for Walt Disney's current full-year earnings is $5.47 per share.

Walt Disney (NYSE:DIS - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The entertainment giant reported $1.45 EPS for the quarter, topping analysts' consensus estimates of $1.21 by $0.24. The firm had revenue of $23.62 billion for the quarter, compared to the consensus estimate of $23.15 billion. Walt Disney had a return on equity of 9.99% and a net margin of 9.47%. The firm's revenue was up 7.0% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.21 earnings per share.

A number of other brokerages have also recently issued reports on DIS. Rosenblatt Securities upped their target price on Walt Disney from $135.00 to $140.00 and gave the stock a "buy" rating in a research report on Tuesday, June 3rd. Barclays raised their price objective on shares of Walt Disney from $115.00 to $120.00 and gave the stock an "overweight" rating in a research note on Thursday, May 8th. Needham & Company LLC restated a "buy" rating and issued a $125.00 price objective on shares of Walt Disney in a research note on Thursday, May 8th. Morgan Stanley raised their target price on Walt Disney from $110.00 to $120.00 and gave the stock an "overweight" rating in a research report on Thursday, May 8th. Finally, Guggenheim lifted their price objective on Walt Disney from $120.00 to $140.00 and gave the company a "buy" rating in a report on Friday. Six equities research analysts have rated the stock with a hold rating, seventeen have assigned a buy rating and two have given a strong buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $124.79.

View Our Latest Analysis on Walt Disney

Walt Disney Stock Up 0.8%

Shares of Walt Disney stock opened at $122.39 on Monday. The stock has a market capitalization of $220.02 billion, a P/E ratio of 25.03, a PEG ratio of 1.79 and a beta of 1.54. The company has a quick ratio of 0.61, a current ratio of 0.67 and a debt-to-equity ratio of 0.34. The stock has a 50 day moving average price of $108.25 and a two-hundred day moving average price of $105.90. Walt Disney has a 12-month low of $80.10 and a 12-month high of $122.94.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in the company. GPM Growth Investors Inc. increased its position in Walt Disney by 4.3% during the 4th quarter. GPM Growth Investors Inc. now owns 2,342 shares of the entertainment giant's stock worth $261,000 after buying an additional 96 shares during the period. Waterloo Capital L.P. increased its position in shares of Walt Disney by 3.2% in the fourth quarter. Waterloo Capital L.P. now owns 3,138 shares of the entertainment giant's stock worth $349,000 after purchasing an additional 97 shares during the period. Quadrant Capital Group LLC increased its position in shares of Walt Disney by 0.4% in the fourth quarter. Quadrant Capital Group LLC now owns 22,658 shares of the entertainment giant's stock worth $2,523,000 after purchasing an additional 98 shares during the period. Acorns Advisers LLC increased its position in shares of Walt Disney by 2.6% in the fourth quarter. Acorns Advisers LLC now owns 3,826 shares of the entertainment giant's stock worth $426,000 after purchasing an additional 98 shares during the period. Finally, Clearstead Trust LLC increased its position in shares of Walt Disney by 0.6% in the first quarter. Clearstead Trust LLC now owns 16,509 shares of the entertainment giant's stock worth $1,629,000 after purchasing an additional 99 shares during the period. Institutional investors own 65.71% of the company's stock.

Insider Activity at Walt Disney

In other Walt Disney news, EVP Brent Woodford sold 1,000 shares of the stock in a transaction on Tuesday, May 13th. The stock was sold at an average price of $110.84, for a total transaction of $110,840.00. Following the transaction, the executive vice president now owns 46,831 shares in the company, valued at $5,190,748.04. This trade represents a 2.09% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.16% of the stock is owned by company insiders.

About Walt Disney

(

Get Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.