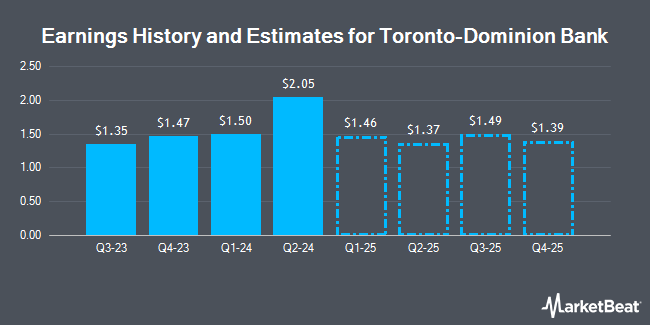

The Toronto-Dominion Bank (NYSE:TD - Free Report) TSE: TD - National Bank Financial increased their Q3 2025 earnings per share estimates for Toronto-Dominion Bank in a research note issued to investors on Thursday, May 22nd. National Bank Financial analyst G. Dechaine now anticipates that the bank will post earnings per share of $1.51 for the quarter, up from their prior forecast of $1.43. The consensus estimate for Toronto-Dominion Bank's current full-year earnings is $5.48 per share. National Bank Financial also issued estimates for Toronto-Dominion Bank's Q4 2025 earnings at $1.40 EPS and FY2025 earnings at $5.77 EPS.

Toronto-Dominion Bank (NYSE:TD - Get Free Report) TSE: TD last released its earnings results on Thursday, May 22nd. The bank reported $1.39 EPS for the quarter, topping analysts' consensus estimates of $1.25 by $0.14. The business had revenue of $10.97 billion during the quarter, compared to analysts' expectations of $13.36 billion. Toronto-Dominion Bank had a net margin of 7.37% and a return on equity of 13.96%. During the same quarter in the previous year, the company earned $2.04 earnings per share.

Several other equities research analysts also recently weighed in on TD. Royal Bank of Canada upped their price target on Toronto-Dominion Bank from $87.00 to $93.00 and gave the stock a "sector perform" rating in a report on Friday, May 23rd. Scotiabank initiated coverage on Toronto-Dominion Bank in a report on Thursday, May 15th. They issued a "sector perform" rating for the company. Wall Street Zen upgraded Toronto-Dominion Bank from a "sell" rating to a "hold" rating in a research report on Saturday, May 24th. Finally, Jefferies Financial Group cut shares of Toronto-Dominion Bank from a "buy" rating to a "hold" rating in a research note on Tuesday, February 18th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat, Toronto-Dominion Bank presently has a consensus rating of "Hold" and an average target price of $93.00.

View Our Latest Report on TD

Toronto-Dominion Bank Trading Up 0.2%

Shares of NYSE:TD traded up $0.16 during midday trading on Monday, reaching $68.90. 110,206 shares of the company's stock were exchanged, compared to its average volume of 2,355,771. Toronto-Dominion Bank has a fifty-two week low of $51.25 and a fifty-two week high of $68.89. The company has a debt-to-equity ratio of 0.11, a current ratio of 1.03 and a quick ratio of 1.03. The firm's 50 day simple moving average is $62.04 and its two-hundred day simple moving average is $58.45. The stock has a market cap of $119.59 billion, a price-to-earnings ratio of 19.84, a P/E/G ratio of 1.95 and a beta of 0.81.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in the stock. Vanguard Group Inc. increased its stake in shares of Toronto-Dominion Bank by 0.7% in the 1st quarter. Vanguard Group Inc. now owns 74,634,839 shares of the bank's stock valued at $4,472,194,000 after buying an additional 516,288 shares during the period. FIL Ltd lifted its position in shares of Toronto-Dominion Bank by 17.3% in the fourth quarter. FIL Ltd now owns 38,989,749 shares of the bank's stock valued at $2,075,819,000 after buying an additional 5,756,584 shares during the last quarter. TD Asset Management Inc raised its position in shares of Toronto-Dominion Bank by 0.4% in the first quarter. TD Asset Management Inc now owns 37,035,579 shares of the bank's stock valued at $2,218,918,000 after purchasing an additional 162,563 shares during the period. Mackenzie Financial Corp increased its position in Toronto-Dominion Bank by 4.5% during the 1st quarter. Mackenzie Financial Corp now owns 29,252,736 shares of the bank's stock worth $1,752,806,000 after buying an additional 1,262,062 shares during the period. Finally, Norges Bank acquired a new position in shares of Toronto-Dominion Bank during the 4th quarter worth approximately $992,204,000. Institutional investors and hedge funds own 52.37% of the company's stock.

Toronto-Dominion Bank Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, July 31st. Stockholders of record on Thursday, July 10th will be paid a $0.7568 dividend. This represents a $3.03 dividend on an annualized basis and a dividend yield of 4.39%. This is a boost from Toronto-Dominion Bank's previous quarterly dividend of $0.73. The ex-dividend date of this dividend is Thursday, July 10th. Toronto-Dominion Bank's payout ratio is presently 42.67%.

About Toronto-Dominion Bank

(

Get Free Report)

The Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

Featured Articles

Before you consider Toronto Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto Dominion Bank wasn't on the list.

While Toronto Dominion Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.