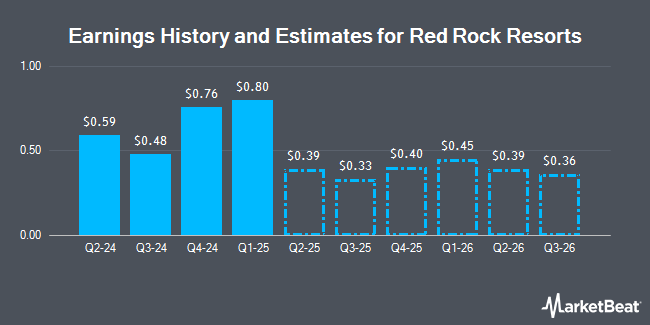

Red Rock Resorts, Inc. (NASDAQ:RRR - Free Report) - Analysts at Zacks Research decreased their Q3 2025 earnings per share (EPS) estimates for Red Rock Resorts in a research report issued on Thursday, May 22nd. Zacks Research analyst M. Kaushik now forecasts that the company will earn $0.33 per share for the quarter, down from their previous estimate of $0.36. The consensus estimate for Red Rock Resorts' current full-year earnings is $1.76 per share. Zacks Research also issued estimates for Red Rock Resorts' Q4 2025 earnings at $0.40 EPS, Q1 2026 earnings at $0.45 EPS, Q2 2026 earnings at $0.39 EPS, Q3 2026 earnings at $0.36 EPS, Q4 2026 earnings at $0.42 EPS, FY2026 earnings at $1.61 EPS and Q1 2027 earnings at $0.39 EPS.

Red Rock Resorts (NASDAQ:RRR - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The company reported $0.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.47 by $0.33. Red Rock Resorts had a return on equity of 71.00% and a net margin of 7.94%. The company had revenue of $497.86 million during the quarter, compared to analyst estimates of $499.12 million. During the same quarter in the previous year, the firm posted $0.68 EPS. The firm's quarterly revenue was up 1.8% on a year-over-year basis.

A number of other research analysts have also recently issued reports on RRR. JMP Securities cut their price objective on Red Rock Resorts from $59.00 to $55.00 and set a "market outperform" rating for the company in a report on Thursday, April 17th. Stifel Nicolaus lowered their target price on Red Rock Resorts from $54.00 to $44.00 and set a "hold" rating for the company in a report on Friday, May 2nd. Truist Financial cut their price target on Red Rock Resorts from $56.00 to $45.00 and set a "hold" rating on the stock in a report on Wednesday, April 23rd. Barclays dropped their target price on shares of Red Rock Resorts from $58.00 to $54.00 and set an "overweight" rating on the stock in a research note on Tuesday, April 22nd. Finally, Susquehanna dropped their price objective on Red Rock Resorts from $61.00 to $52.00 and set a "positive" rating for the company in a research note on Wednesday, April 16th. Six investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $52.64.

View Our Latest Report on Red Rock Resorts

Red Rock Resorts Stock Up 0.1%

Shares of RRR stock traded up $0.06 on Monday, reaching $48.89. 50,067 shares of the company's stock traded hands, compared to its average volume of 674,728. The business's 50 day moving average price is $43.42 and its two-hundred day moving average price is $46.49. The company has a debt-to-equity ratio of 14.28, a quick ratio of 0.96 and a current ratio of 1.02. Red Rock Resorts has a 12-month low of $35.09 and a 12-month high of $61.73. The company has a market capitalization of $5.18 billion, a P/E ratio of 19.48, a price-to-earnings-growth ratio of 4.32 and a beta of 1.64.

Red Rock Resorts Dividend Announcement

The business also recently announced an annual dividend, which will be paid on Monday, June 30th. Stockholders of record on Monday, June 16th will be paid a dividend of $1.00 per share. The ex-dividend date is Monday, June 16th. This represents a dividend yield of 2.29%. Red Rock Resorts's dividend payout ratio is currently 38.76%.

Institutional Trading of Red Rock Resorts

Several large investors have recently made changes to their positions in the company. Sterling Capital Management LLC raised its stake in shares of Red Rock Resorts by 654.7% in the 4th quarter. Sterling Capital Management LLC now owns 883 shares of the company's stock valued at $41,000 after acquiring an additional 766 shares during the period. Pandora Wealth Inc. acquired a new position in shares of Red Rock Resorts during the first quarter worth $43,000. US Bancorp DE raised its stake in Red Rock Resorts by 1,664.4% in the first quarter. US Bancorp DE now owns 1,041 shares of the company's stock valued at $45,000 after buying an additional 982 shares in the last quarter. KBC Group NV lifted its holdings in Red Rock Resorts by 37.1% during the 4th quarter. KBC Group NV now owns 1,996 shares of the company's stock worth $92,000 after buying an additional 540 shares during the last quarter. Finally, New Age Alpha Advisors LLC acquired a new position in shares of Red Rock Resorts during the 1st quarter worth about $89,000. 47.84% of the stock is currently owned by hedge funds and other institutional investors.

Red Rock Resorts Company Profile

(

Get Free Report)

Red Rock Resorts, Inc, through its interest in Station Casinos LLC, develops and operates casino and entertainment properties in the United States. The company owns and operates gaming and entertainment facilities, including Durango Casino & Resort and smaller casinos in the Las Vegas regional market.

Featured Stories

Before you consider Red Rock Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Red Rock Resorts wasn't on the list.

While Red Rock Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.