Raymond James Financial Inc. acquired a new stake in shares of Enerpac Tool Group Corp. (NYSE:EPAC - Free Report) during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm acquired 28,835 shares of the company's stock, valued at approximately $1,185,000. Raymond James Financial Inc. owned 0.05% of Enerpac Tool Group as of its most recent SEC filing.

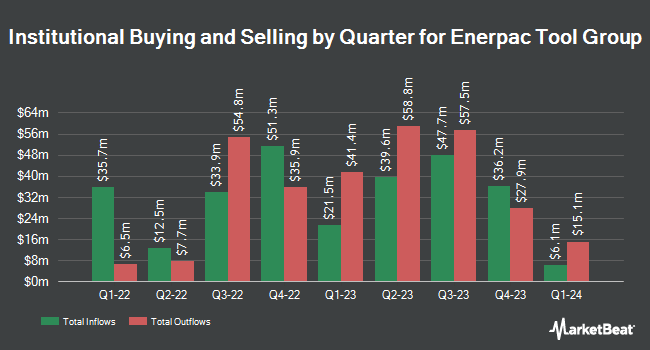

Several other hedge funds and other institutional investors also recently modified their holdings of EPAC. Assetmark Inc. bought a new stake in Enerpac Tool Group in the fourth quarter worth $29,000. First Horizon Advisors Inc. bought a new stake in shares of Enerpac Tool Group in the 4th quarter valued at about $36,000. Venturi Wealth Management LLC acquired a new stake in shares of Enerpac Tool Group during the fourth quarter worth $51,000. Heck Capital Advisors LLC bought a new position in shares of Enerpac Tool Group in the 4th quarter valued at about $99,000. Finally, KBC Group NV increased its position in Enerpac Tool Group by 91.7% during the fourth quarter. KBC Group NV now owns 2,561 shares of the company's stock worth $105,000 after buying an additional 1,225 shares during the last quarter. Institutional investors own 97.70% of the company's stock.

Analyst Upgrades and Downgrades

Separately, CJS Securities started coverage on Enerpac Tool Group in a research note on Friday, March 14th. They set an "outperform" rating and a $53.00 target price for the company.

Get Our Latest Analysis on Enerpac Tool Group

Enerpac Tool Group Price Performance

NYSE:EPAC traded up $0.28 during trading hours on Friday, hitting $43.51. The stock had a trading volume of 34,519 shares, compared to its average volume of 329,705. The company has a debt-to-equity ratio of 0.47, a current ratio of 2.92 and a quick ratio of 2.24. Enerpac Tool Group Corp. has a one year low of $35.18 and a one year high of $51.91. The firm has a market capitalization of $2.35 billion, a price-to-earnings ratio of 26.53 and a beta of 1.20. The company has a 50 day simple moving average of $41.99 and a two-hundred day simple moving average of $44.29.

Enerpac Tool Group (NYSE:EPAC - Get Free Report) last announced its quarterly earnings data on Monday, March 24th. The company reported $0.39 EPS for the quarter, meeting the consensus estimate of $0.39. Enerpac Tool Group had a return on equity of 25.39% and a net margin of 15.14%. The business had revenue of $145.53 million during the quarter, compared to analyst estimates of $139.80 million. Research analysts forecast that Enerpac Tool Group Corp. will post 1.78 earnings per share for the current fiscal year.

About Enerpac Tool Group

(

Free Report)

Enerpac Tool Group Corp. manufactures and sells a range of industrial products and solutions in the United States, the United Kingdom, Germany, Australia, Canada, China, Saudi Arabia, Brazil, France, and internationally. It operates through Industrial Tools & Services and Other segments. The Industrial Tools & Services segment designs, manufactures, and distributes branded hydraulic and mechanical tools; and provides services and tool rentals to the infrastructure, industrial maintenance, repair and operations, oil and gas, mining, alternative and renewable energy, civil construction, and other markets.

Read More

Before you consider Enerpac Tool Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enerpac Tool Group wasn't on the list.

While Enerpac Tool Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.