Redwood Investments LLC cut its holdings in shares of Arcos Dorados Holdings Inc. (NYSE:ARCO - Free Report) by 95.3% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 20,438 shares of the restaurant operator's stock after selling 412,063 shares during the quarter. Redwood Investments LLC's holdings in Arcos Dorados were worth $149,000 as of its most recent filing with the Securities and Exchange Commission.

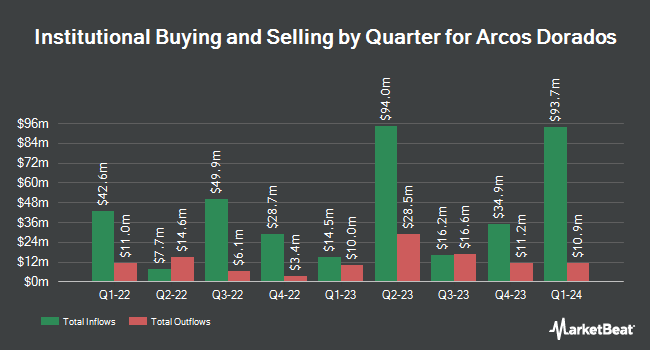

A number of other hedge funds have also recently made changes to their positions in ARCO. Price T Rowe Associates Inc. MD raised its stake in Arcos Dorados by 40.1% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 13,463,466 shares of the restaurant operator's stock valued at $98,015,000 after buying an additional 3,851,704 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its holdings in shares of Arcos Dorados by 96.0% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 3,280,985 shares of the restaurant operator's stock valued at $23,886,000 after purchasing an additional 1,606,821 shares during the period. Emeth Value Capital LLC purchased a new position in Arcos Dorados during the fourth quarter worth about $11,190,000. Franklin Resources Inc. lifted its holdings in Arcos Dorados by 88.1% in the fourth quarter. Franklin Resources Inc. now owns 2,611,023 shares of the restaurant operator's stock valued at $19,008,000 after acquiring an additional 1,223,260 shares during the period. Finally, Private Management Group Inc. grew its holdings in shares of Arcos Dorados by 34.7% in the 4th quarter. Private Management Group Inc. now owns 3,167,857 shares of the restaurant operator's stock worth $23,062,000 after acquiring an additional 815,198 shares during the period. Hedge funds and other institutional investors own 55.91% of the company's stock.

Arcos Dorados Stock Down 1.6%

NYSE:ARCO traded down $0.13 on Tuesday, reaching $7.55. The stock had a trading volume of 314,089 shares, compared to its average volume of 1,555,672. Arcos Dorados Holdings Inc. has a 12-month low of $6.66 and a 12-month high of $10.55. The stock has a market cap of $1.59 billion, a P/E ratio of 10.78 and a beta of 0.65. The company has a current ratio of 0.63, a quick ratio of 0.57 and a debt-to-equity ratio of 1.40. The company has a 50-day moving average of $7.70 and a 200 day moving average of $7.84.

Arcos Dorados (NYSE:ARCO - Get Free Report) last announced its quarterly earnings data on Wednesday, May 14th. The restaurant operator reported $0.07 earnings per share for the quarter, missing the consensus estimate of $0.13 by ($0.06). Arcos Dorados had a net margin of 3.25% and a return on equity of 29.74%. The firm had revenue of $1.08 billion during the quarter, compared to the consensus estimate of $1.02 billion. During the same period in the prior year, the firm earned $0.14 earnings per share. The firm's quarterly revenue was down .4% compared to the same quarter last year. On average, research analysts predict that Arcos Dorados Holdings Inc. will post 0.63 earnings per share for the current year.

Arcos Dorados Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 26th. Shareholders of record on Monday, December 22nd will be paid a dividend of $0.06 per share. The ex-dividend date of this dividend is Monday, December 22nd. This represents a $0.24 annualized dividend and a yield of 3.18%. Arcos Dorados's payout ratio is 36.92%.

Analyst Ratings Changes

Separately, StockNews.com lowered shares of Arcos Dorados from a "buy" rating to a "hold" rating in a research report on Wednesday, March 26th.

Check Out Our Latest Report on Arcos Dorados

Arcos Dorados Profile

(

Free Report)

Arcos Dorados Holdings Inc operates as a franchisee of McDonald's restaurants. It has the exclusive right to own, operate, and grant franchises of McDonald's restaurants in 20 countries and territories in Latin America and the Caribbean, including Argentina, Aruba, Brazil, Chile, Colombia, Costa Rica, Curacao, Ecuador, French Guiana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico, Trinidad and Tobago, Uruguay, the U.S.

Featured Stories

Before you consider Arcos Dorados, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcos Dorados wasn't on the list.

While Arcos Dorados currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.