Cutter Capital Management LP boosted its position in shares of Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 117.6% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 31,500 shares of the biopharmaceutical company's stock after purchasing an additional 17,024 shares during the quarter. Regeneron Pharmaceuticals makes up 9.2% of Cutter Capital Management LP's portfolio, making the stock its biggest holding. Cutter Capital Management LP's holdings in Regeneron Pharmaceuticals were worth $22,438,000 at the end of the most recent quarter.

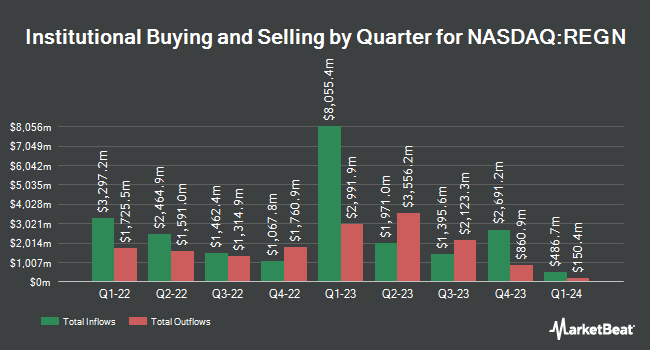

Other large investors also recently bought and sold shares of the company. Willner & Heller LLC grew its stake in Regeneron Pharmaceuticals by 3.9% during the 4th quarter. Willner & Heller LLC now owns 399 shares of the biopharmaceutical company's stock worth $284,000 after buying an additional 15 shares during the last quarter. OLD Second National Bank of Aurora raised its position in shares of Regeneron Pharmaceuticals by 0.5% during the 4th quarter. OLD Second National Bank of Aurora now owns 2,843 shares of the biopharmaceutical company's stock worth $2,025,000 after buying an additional 15 shares in the last quarter. Rakuten Securities Inc. lifted its holdings in shares of Regeneron Pharmaceuticals by 62.5% in the fourth quarter. Rakuten Securities Inc. now owns 39 shares of the biopharmaceutical company's stock valued at $28,000 after buying an additional 15 shares during the period. TD Private Client Wealth LLC boosted its stake in shares of Regeneron Pharmaceuticals by 9.6% during the 4th quarter. TD Private Client Wealth LLC now owns 171 shares of the biopharmaceutical company's stock worth $122,000 after acquiring an additional 15 shares in the last quarter. Finally, Manchester Capital Management LLC raised its holdings in shares of Regeneron Pharmaceuticals by 12.6% during the fourth quarter. Manchester Capital Management LLC now owns 161 shares of the biopharmaceutical company's stock valued at $115,000 after acquiring an additional 18 shares during the period. Institutional investors and hedge funds own 83.31% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently weighed in on the stock. Cantor Fitzgerald started coverage on shares of Regeneron Pharmaceuticals in a research note on Tuesday, April 22nd. They issued an "overweight" rating and a $695.00 price target on the stock. Wells Fargo & Company decreased their price objective on shares of Regeneron Pharmaceuticals from $750.00 to $700.00 and set an "overweight" rating for the company in a report on Wednesday, April 30th. Citigroup cut their target price on Regeneron Pharmaceuticals from $795.00 to $750.00 and set a "neutral" rating on the stock in a report on Tuesday, January 28th. Bernstein Bank cut their price objective on Regeneron Pharmaceuticals from $1,070.00 to $1,000.00 in a research note on Tuesday, February 4th. Finally, Sanford C. Bernstein decreased their target price on Regeneron Pharmaceuticals from $1,110.00 to $1,070.00 and set an "outperform" rating for the company in a research report on Tuesday, January 7th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating, eighteen have given a buy rating and three have issued a strong buy rating to the stock. According to data from MarketBeat, Regeneron Pharmaceuticals currently has an average rating of "Moderate Buy" and an average target price of $892.60.

View Our Latest Research Report on REGN

Regeneron Pharmaceuticals Trading Down 0.3 %

NASDAQ:REGN opened at $603.58 on Tuesday. Regeneron Pharmaceuticals, Inc. has a one year low of $525.99 and a one year high of $1,211.20. The company has a debt-to-equity ratio of 0.09, a current ratio of 4.73 and a quick ratio of 3.95. The company has a market cap of $65.99 billion, a PE ratio of 15.77, a PEG ratio of 2.34 and a beta of 0.43. The firm has a 50-day moving average of $624.42 and a 200-day moving average of $704.67.

Regeneron Pharmaceuticals (NASDAQ:REGN - Get Free Report) last announced its quarterly earnings results on Tuesday, April 29th. The biopharmaceutical company reported $8.22 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $8.83 by ($0.61). The firm had revenue of $3.03 billion during the quarter, compared to analysts' expectations of $3.40 billion. Regeneron Pharmaceuticals had a return on equity of 16.32% and a net margin of 31.07%. The company's quarterly revenue was down 3.7% compared to the same quarter last year. During the same period in the previous year, the company posted $9.55 earnings per share. As a group, equities research analysts expect that Regeneron Pharmaceuticals, Inc. will post 35.92 EPS for the current fiscal year.

Regeneron Pharmaceuticals Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, June 6th. Investors of record on Tuesday, May 20th will be paid a $0.88 dividend. This represents a $3.52 dividend on an annualized basis and a yield of 0.58%. The ex-dividend date of this dividend is Tuesday, May 20th. Regeneron Pharmaceuticals's payout ratio is 8.96%.

Regeneron Pharmaceuticals Company Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Further Reading

Want to see what other hedge funds are holding REGN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.