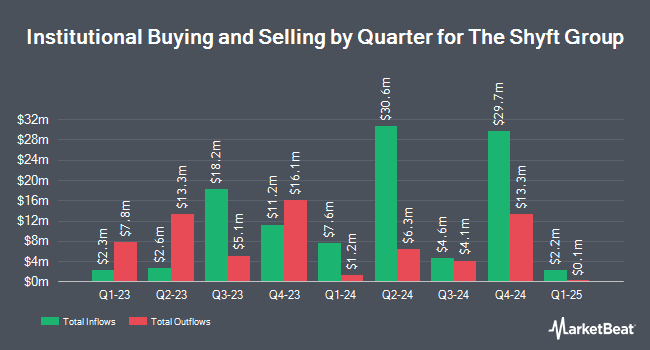

Renaissance Technologies LLC purchased a new position in shares of The Shyft Group, Inc. (NASDAQ:SHYF - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm purchased 69,521 shares of the company's stock, valued at approximately $816,000. Renaissance Technologies LLC owned 0.20% of The Shyft Group as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also modified their holdings of the company. Murphy & Mullick Capital Management Corp acquired a new stake in shares of The Shyft Group during the fourth quarter worth $41,000. Quantbot Technologies LP purchased a new stake in shares of The Shyft Group in the fourth quarter valued at $48,000. Raymond James Financial Inc. purchased a new position in The Shyft Group during the fourth quarter valued at approximately $209,000. SG Americas Securities LLC increased its position in The Shyft Group by 24.3% in the 4th quarter. SG Americas Securities LLC now owns 18,274 shares of the company's stock worth $215,000 after purchasing an additional 3,575 shares during the last quarter. Finally, Trexquant Investment LP lifted its stake in shares of The Shyft Group by 63.5% in the 4th quarter. Trexquant Investment LP now owns 29,466 shares of the company's stock valued at $346,000 after purchasing an additional 11,445 shares during the last quarter. 85.84% of the stock is owned by institutional investors and hedge funds.

The Shyft Group Stock Down 2.0 %

Shares of SHYF stock traded down $0.17 during trading on Wednesday, reaching $8.73. The company's stock had a trading volume of 178,531 shares, compared to its average volume of 290,867. The company has a quick ratio of 1.16, a current ratio of 1.82 and a debt-to-equity ratio of 0.44. The business has a fifty day moving average price of $8.52 and a 200-day moving average price of $11.09. The company has a market cap of $305.46 million, a price-to-earnings ratio of -96.94 and a beta of 1.93. The Shyft Group, Inc. has a one year low of $6.82 and a one year high of $17.56.

The Shyft Group (NASDAQ:SHYF - Get Free Report) last announced its earnings results on Thursday, February 20th. The company reported $0.05 EPS for the quarter, missing the consensus estimate of $0.14 by ($0.09). The business had revenue of $201.43 million for the quarter, compared to the consensus estimate of $211.90 million. The Shyft Group had a positive return on equity of 2.75% and a negative net margin of 0.36%. Analysts anticipate that The Shyft Group, Inc. will post 0.68 earnings per share for the current year.

The Shyft Group Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, June 16th. Shareholders of record on Friday, May 16th will be issued a dividend of $0.05 per share. This represents a $0.20 dividend on an annualized basis and a yield of 2.29%. The ex-dividend date is Friday, May 16th. The Shyft Group's dividend payout ratio is 2,000.00%.

Wall Street Analysts Forecast Growth

Separately, DA Davidson upgraded shares of The Shyft Group from a "neutral" rating to a "buy" rating and set a $15.00 price target on the stock in a research note on Wednesday, January 15th.

Read Our Latest Stock Report on SHYF

The Shyft Group Company Profile

(

Free Report)

The Shyft Group, Inc engages in the manufacture and assembly of specialty vehicles for the commercial and recreational vehicle industries in the United States and internationally. It operates in two segments, Fleet Vehicles and Services, and Specialty Vehicles. The Fleet Vehicles and Services segment offers commercial vehicles used in the e-commerce/last mile/parcel delivery, beverage and grocery delivery, laundry and linen, mobile retail, and trades and construction industries.

See Also

Before you consider The Shyft Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Shyft Group wasn't on the list.

While The Shyft Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.