Renaissance Technologies LLC lifted its holdings in Hyliion Holdings Corp. (NYSE:HYLN - Free Report) by 49.1% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,290,566 shares of the company's stock after acquiring an additional 424,866 shares during the period. Renaissance Technologies LLC owned 0.74% of Hyliion worth $3,368,000 at the end of the most recent quarter.

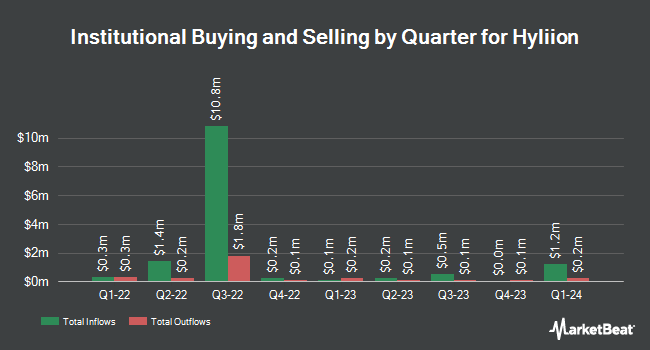

Other institutional investors have also recently made changes to their positions in the company. Wells Fargo & Company MN raised its holdings in shares of Hyliion by 35.7% in the fourth quarter. Wells Fargo & Company MN now owns 93,123 shares of the company's stock worth $243,000 after buying an additional 24,474 shares during the period. ExodusPoint Capital Management LP bought a new position in Hyliion in the 4th quarter valued at $81,000. JPMorgan Chase & Co. grew its position in Hyliion by 405.6% in the 4th quarter. JPMorgan Chase & Co. now owns 321,008 shares of the company's stock valued at $838,000 after acquiring an additional 257,514 shares during the last quarter. EntryPoint Capital LLC bought a new position in Hyliion in the 4th quarter valued at $81,000. Finally, Prudential Financial Inc. bought a new position in shares of Hyliion during the 4th quarter worth $272,000. Institutional investors own 22.81% of the company's stock.

Hyliion Stock Down 2.2 %

Shares of NYSE HYLN traded down $0.04 during mid-day trading on Tuesday, reaching $1.56. 73,728 shares of the company were exchanged, compared to its average volume of 960,859. The stock has a market cap of $271.85 million, a price-to-earnings ratio of -4.18 and a beta of 2.52. Hyliion Holdings Corp. has a 1 year low of $1.17 and a 1 year high of $4.10. The firm has a 50-day moving average of $1.51 and a 200 day moving average of $2.25.

Hyliion Company Profile

(

Free Report)

Recommended Stories

Before you consider Hyliion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hyliion wasn't on the list.

While Hyliion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.