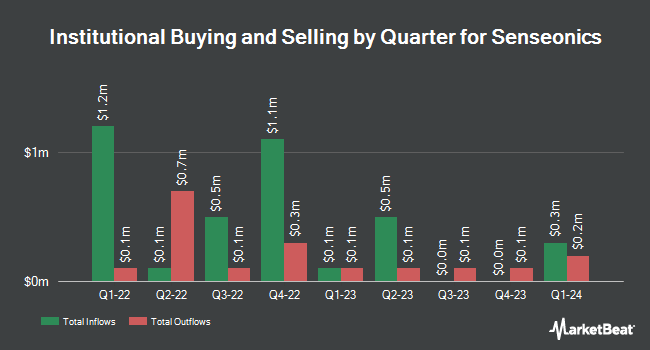

Renaissance Technologies LLC purchased a new position in Senseonics Holdings, Inc. (NYSE:SENS - Free Report) during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The firm purchased 1,376,020 shares of the company's stock, valued at approximately $720,000. Renaissance Technologies LLC owned about 0.23% of Senseonics at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the stock. Charles Schwab Investment Management Inc. raised its holdings in shares of Senseonics by 9.0% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 3,339,698 shares of the company's stock valued at $1,748,000 after buying an additional 274,842 shares during the last quarter. Raymond James Financial Inc. acquired a new position in Senseonics during the 4th quarter worth $26,000. Geode Capital Management LLC grew its stake in shares of Senseonics by 3.2% in the third quarter. Geode Capital Management LLC now owns 5,838,396 shares of the company's stock worth $2,042,000 after purchasing an additional 179,103 shares in the last quarter. HighTower Advisors LLC acquired a new position in shares of Senseonics during the fourth quarter valued at $32,000. Finally, Virtu Financial LLC bought a new stake in shares of Senseonics during the fourth quarter valued at about $148,000. Institutional investors and hedge funds own 12.36% of the company's stock.

Senseonics Price Performance

Senseonics stock traded up $0.03 during mid-day trading on Wednesday, hitting $0.69. The company's stock had a trading volume of 1,652,729 shares, compared to its average volume of 6,335,213. Senseonics Holdings, Inc. has a twelve month low of $0.25 and a twelve month high of $1.40. The stock's fifty day moving average price is $0.66 and its two-hundred day moving average price is $0.62. The stock has a market capitalization of $451.41 million, a P/E ratio of -5.31 and a beta of 1.05. The company has a quick ratio of 2.38, a current ratio of 2.47 and a debt-to-equity ratio of 59.17.

Senseonics (NYSE:SENS - Get Free Report) last released its quarterly earnings results on Monday, March 3rd. The company reported ($0.12) earnings per share for the quarter, missing analysts' consensus estimates of ($0.03) by ($0.09). Senseonics had a negative net margin of 362.30% and a negative return on equity of 842.25%. During the same period last year, the business posted ($0.07) earnings per share. Research analysts forecast that Senseonics Holdings, Inc. will post -0.14 earnings per share for the current year.

Wall Street Analyst Weigh In

SENS has been the topic of several research analyst reports. Mizuho assumed coverage on shares of Senseonics in a research note on Thursday, April 10th. They set an "outperform" rating and a $2.00 target price on the stock. HC Wainwright reissued a "buy" rating and set a $2.00 target price on shares of Senseonics in a report on Wednesday, March 5th.

Get Our Latest Stock Analysis on Senseonics

About Senseonics

(

Free Report)

Senseonics Holdings, Inc, a medical technology company, focuses on development and manufacturing of continuous glucose monitoring (CGM) systems for people with diabetes in the United States and internationally. The company's products include Eversense, Eversense XL, and Eversense E3 that are implantable CGM systems to measure glucose levels in people with diabetes through an under-the-skin sensor, a removable and rechargeable smart transmitter, and a convenient app for real-time diabetes monitoring and management.

Read More

Before you consider Senseonics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Senseonics wasn't on the list.

While Senseonics currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.