Renaissance Technologies LLC trimmed its position in Five Point Holdings, LLC (NYSE:FPH - Free Report) by 23.9% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 373,900 shares of the company's stock after selling 117,200 shares during the quarter. Renaissance Technologies LLC owned 0.25% of Five Point worth $1,413,000 at the end of the most recent reporting period.

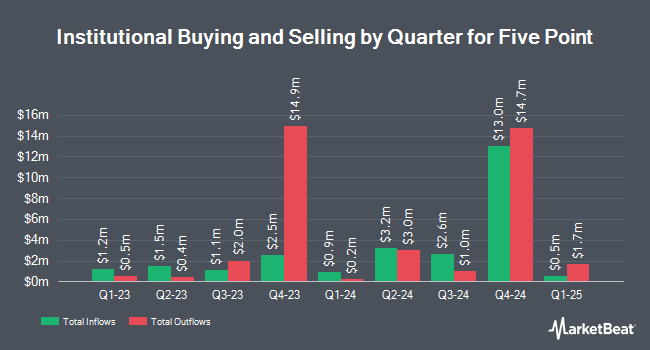

Other institutional investors have also added to or reduced their stakes in the company. Private Management Group Inc. grew its holdings in shares of Five Point by 9.8% during the 4th quarter. Private Management Group Inc. now owns 5,525,607 shares of the company's stock valued at $20,887,000 after purchasing an additional 493,138 shares during the last quarter. Arrowstreet Capital Limited Partnership boosted its position in Five Point by 2,431.5% in the fourth quarter. Arrowstreet Capital Limited Partnership now owns 436,686 shares of the company's stock valued at $1,651,000 after buying an additional 419,436 shares in the last quarter. Raymond James Financial Inc. bought a new stake in shares of Five Point during the fourth quarter worth $1,274,000. O Keefe Stevens Advisory Inc. increased its holdings in shares of Five Point by 8.1% during the fourth quarter. O Keefe Stevens Advisory Inc. now owns 2,182,172 shares of the company's stock worth $8,249,000 after buying an additional 163,647 shares in the last quarter. Finally, Robotti Robert lifted its stake in shares of Five Point by 1.1% in the 4th quarter. Robotti Robert now owns 6,779,047 shares of the company's stock valued at $25,625,000 after acquiring an additional 75,000 shares during the last quarter. 38.09% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Zelman & Associates raised Five Point from a "neutral" rating to an "outperform" rating in a research note on Monday, January 27th.

Get Our Latest Research Report on Five Point

Insiders Place Their Bets

In other Five Point news, insider Kim Tobler sold 18,496 shares of the stock in a transaction that occurred on Saturday, March 8th. The stock was sold at an average price of $5.78, for a total transaction of $106,906.88. Following the transaction, the insider now directly owns 17,927 shares in the company, valued at approximately $103,618.06. This represents a 50.78 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 21.49% of the company's stock.

Five Point Stock Up 1.5 %

FPH traded up $0.08 during midday trading on Friday, hitting $5.29. 147,181 shares of the company were exchanged, compared to its average volume of 280,380. The firm has a market capitalization of $786.69 million, a P/E ratio of 5.51 and a beta of 1.51. The firm's 50 day moving average price is $5.27 and its 200-day moving average price is $4.68. Five Point Holdings, LLC has a 1-year low of $2.88 and a 1-year high of $6.71.

Five Point (NYSE:FPH - Get Free Report) last issued its quarterly earnings results on Thursday, April 24th. The company reported $0.32 earnings per share (EPS) for the quarter. Five Point had a net margin of 28.70% and a return on equity of 3.38%. The firm had revenue of $13.16 million for the quarter.

Five Point Profile

(

Free Report)

Five Point Holdings, LLC, through its subsidiary, Five Point Operating Company, LP, owns and develops mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County. The company operates in four segments: Valencia, San Francisco, Great Park, and Commercial. It sells residential and commercial land sites to homebuilders, commercial developers, and commercial buyers; operates and owns a commercial office, research and development, medical campus, and other properties; and provides development and property management services.

Featured Articles

Before you consider Five Point, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Point wasn't on the list.

While Five Point currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.