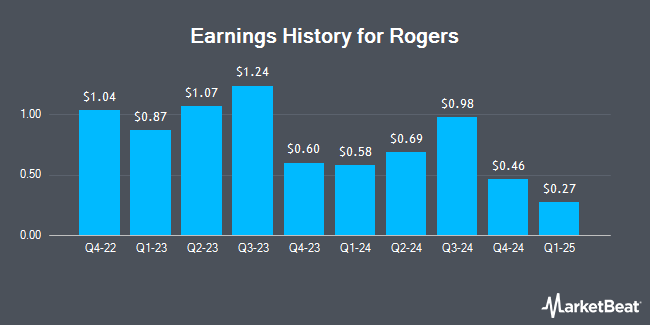

Rogers (NYSE:ROG - Get Free Report) is anticipated to post its Q2 2025 quarterly earnings results before the market opens on Thursday, July 24th. Analysts expect Rogers to post earnings of $0.50 per share and revenue of $198.75 million for the quarter. Rogers has set its Q2 2025 guidance at 0.300-0.700 EPS.

Rogers (NYSE:ROG - Get Free Report) last posted its quarterly earnings data on Tuesday, April 29th. The electronics maker reported $0.27 earnings per share for the quarter, beating the consensus estimate of $0.24 by $0.03. The business had revenue of $190.50 million for the quarter, compared to analysts' expectations of $187.50 million. Rogers had a return on equity of 3.52% and a net margin of 2.09%. On average, analysts expect Rogers to post $4 EPS for the current fiscal year and $5 EPS for the next fiscal year.

Rogers Stock Performance

Rogers stock opened at $65.74 on Thursday. The stock's 50 day simple moving average is $68.87 and its two-hundred day simple moving average is $75.25. The stock has a market cap of $1.22 billion, a price-to-earnings ratio of 72.24 and a beta of 0.44. Rogers has a fifty-two week low of $51.43 and a fifty-two week high of $134.07.

Insider Activity at Rogers

In other news, VP Griffin Melaney Gappert sold 756 shares of the business's stock in a transaction that occurred on Thursday, May 1st. The stock was sold at an average price of $62.55, for a total value of $47,287.80. Following the sale, the vice president directly owned 4,484 shares of the company's stock, valued at $280,474.20. The trade was a 14.43% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. 1.35% of the stock is currently owned by corporate insiders.

Institutional Trading of Rogers

A number of hedge funds have recently made changes to their positions in ROG. Royal Bank of Canada raised its holdings in Rogers by 15.7% in the 1st quarter. Royal Bank of Canada now owns 4,276 shares of the electronics maker's stock worth $288,000 after acquiring an additional 580 shares during the last quarter. AQR Capital Management LLC raised its holdings in Rogers by 121.3% in the 1st quarter. AQR Capital Management LLC now owns 8,376 shares of the electronics maker's stock worth $566,000 after acquiring an additional 4,591 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in Rogers by 5.0% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 11,221 shares of the electronics maker's stock worth $758,000 after acquiring an additional 536 shares during the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its holdings in Rogers by 4.9% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 51,135 shares of the electronics maker's stock worth $3,453,000 after acquiring an additional 2,405 shares during the last quarter. Finally, Jane Street Group LLC purchased a new position in Rogers in the 1st quarter worth approximately $4,345,000. 96.02% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research firms have weighed in on ROG. B. Riley lifted their price objective on Rogers from $80.00 to $85.00 and gave the company a "buy" rating in a research report on Wednesday, April 30th. CL King assumed coverage on Rogers in a research report on Monday, March 31st. They issued a "buy" rating and a $85.00 price target on the stock.

Read Our Latest Stock Analysis on ROG

About Rogers

(

Get Free Report)

Rogers Corporation engages in the design, development, manufacture, and sale of engineered materials and components worldwide. It operates through Advanced Electronics Solutions (AES), Elastomeric Material Solutions (EMS), and Other segments. The AES segment offers circuit materials, ceramic substrate materials, busbars, and cooling solutions for applications in electric and hybrid electric vehicles (EV/HEV), wireless infrastructure, automotive, renewable energy, aerospace and defense, mass transit, industrial, connected devices, and wired infrastructure.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rogers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rogers wasn't on the list.

While Rogers currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.