Onsemi (NASDAQ:ON - Get Free Report) had its target price lifted by stock analysts at Roth Capital from $50.00 to $70.00 in a report released on Tuesday,Benzinga reports. The firm presently has a "buy" rating on the semiconductor company's stock. Roth Capital's price target would suggest a potential upside of 30.49% from the company's previous close.

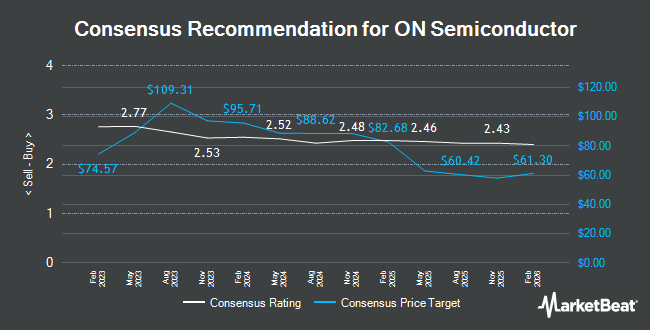

Several other research firms have also recently commented on ON. Morgan Stanley started coverage on shares of Onsemi in a report on Monday, May 12th. They set an "equal weight" rating and a $39.00 price target for the company. Benchmark lowered their target price on shares of Onsemi from $60.00 to $50.00 and set a "buy" rating for the company in a research note on Tuesday, May 6th. UBS Group dropped their target price on Onsemi from $55.00 to $40.00 and set a "neutral" rating on the stock in a report on Tuesday, April 29th. Citigroup lowered their price objective on Onsemi from $52.00 to $40.00 and set a "neutral" rating for the company in a research report on Friday, April 11th. Finally, Mizuho dropped their price objective on Onsemi from $71.00 to $62.00 and set an "outperform" rating on the stock in a report on Monday, March 24th. Twelve equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $55.12.

Read Our Latest Stock Report on Onsemi

Onsemi Stock Performance

NASDAQ ON traded down $0.23 on Tuesday, reaching $53.65. 3,798,756 shares of the company's stock traded hands, compared to its average volume of 8,158,513. The company has a debt-to-equity ratio of 0.38, a quick ratio of 3.38 and a current ratio of 5.06. The stock has a 50 day moving average price of $42.29 and a 200-day moving average price of $49.51. Onsemi has a fifty-two week low of $31.04 and a fifty-two week high of $80.08. The firm has a market cap of $22.42 billion, a price-to-earnings ratio of 14.79, a P/E/G ratio of 16.74 and a beta of 1.39.

Onsemi (NASDAQ:ON - Get Free Report) last posted its quarterly earnings data on Monday, May 5th. The semiconductor company reported $0.55 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.51 by $0.04. Onsemi had a return on equity of 20.10% and a net margin of 22.21%. The company had revenue of $1.45 billion for the quarter, compared to analysts' expectations of $1.40 billion. During the same period in the previous year, the firm posted $1.08 EPS. Onsemi's revenue was down 22.4% compared to the same quarter last year. Equities research analysts predict that Onsemi will post 2.6 EPS for the current fiscal year.

Institutional Trading of Onsemi

Hedge funds have recently made changes to their positions in the stock. Costello Asset Management INC purchased a new stake in Onsemi during the first quarter valued at about $26,000. Golden State Wealth Management LLC boosted its stake in shares of Onsemi by 83.3% during the 1st quarter. Golden State Wealth Management LLC now owns 704 shares of the semiconductor company's stock worth $29,000 after acquiring an additional 320 shares in the last quarter. Elequin Capital LP boosted its holdings in shares of Onsemi by 108.3% during the 4th quarter. Elequin Capital LP now owns 527 shares of the semiconductor company's stock worth $33,000 after buying an additional 274 shares during the period. Opal Wealth Advisors LLC bought a new position in shares of Onsemi in the first quarter worth about $41,000. Finally, Pilgrim Partners Asia Pte Ltd acquired a new position in shares of Onsemi during the fourth quarter worth approximately $43,000. Institutional investors own 97.70% of the company's stock.

About Onsemi

(

Get Free Report)

onsemi is engaged in disruptive innovations and also a supplier of power and analog semiconductors. The firm offers vehicle electrification and safety, sustainable energy grids, industrial automation, and 5G and cloud infrastructure, with a focus on automotive and industrial end-markets. It operates through the following segments: Power Solutions Group, Advanced Solutions Group, and Intelligent Sensing Group.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Onsemi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onsemi wasn't on the list.

While Onsemi currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.