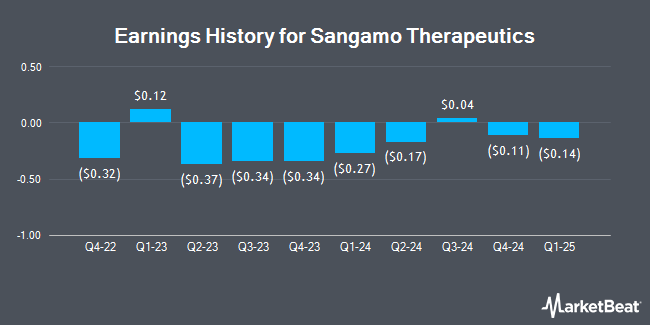

Sangamo Therapeutics (NASDAQ:SGMO - Get Free Report) announced its quarterly earnings results on Monday. The biopharmaceutical company reported ($0.14) EPS for the quarter, missing analysts' consensus estimates of ($0.11) by ($0.03), Zacks reports. Sangamo Therapeutics had a negative net margin of 257.87% and a negative return on equity of 264.16%. The company had revenue of $6.44 million during the quarter, compared to the consensus estimate of $7.90 million.

Sangamo Therapeutics Price Performance

SGMO stock traded up $0.02 during trading hours on Friday, reaching $0.47. 5,907,196 shares of the stock were exchanged, compared to its average volume of 8,744,642. The firm's 50-day moving average is $0.73 and its 200-day moving average is $1.32. Sangamo Therapeutics has a 12 month low of $0.30 and a 12 month high of $3.18. The company has a market cap of $107.72 million, a price-to-earnings ratio of -0.63 and a beta of 1.46.

Wall Street Analysts Forecast Growth

Several equities research analysts have commented on the stock. Barclays lowered their target price on shares of Sangamo Therapeutics from $9.00 to $5.00 and set an "overweight" rating for the company in a research note on Wednesday. Royal Bank of Canada restated a "sector perform" rating and issued a $2.00 price objective on shares of Sangamo Therapeutics in a research report on Tuesday, March 18th. Truist Financial reduced their target price on Sangamo Therapeutics from $7.00 to $5.00 and set a "buy" rating on the stock in a report on Thursday, January 23rd. Finally, HC Wainwright restated a "buy" rating and issued a $10.00 price target on shares of Sangamo Therapeutics in a report on Monday, April 7th. Three analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to data from MarketBeat.com, Sangamo Therapeutics currently has a consensus rating of "Moderate Buy" and a consensus target price of $4.50.

Check Out Our Latest Report on Sangamo Therapeutics

About Sangamo Therapeutics

(

Get Free Report)

Sangamo Therapeutics, Inc, a clinical-stage genomic medicine company, focuses on translating science into medicines that transform the lives of patients and families afflicted with serious diseases in the United States. The company's clinical-stage product candidates are ST-920, a gene therapy product candidate, which is in Phase 1/2 clinical study for the treatment of Fabry disease; TX200, a chimeric antigen receptor engineered regulatory T cell (CAR-Treg) therapy product candidate that is in Phase 1/2 clinical study for the prevention of immune-mediated rejection in HLA-A2 mismatched kidney transplantation; SB-525, a gene therapy product candidate, which is in Phase 3 clinical trial for the treatment of moderately severe to severe hemophilia A; BIVV003, a zinc finger nuclease gene-edited cell therapy product candidate that is in Phase 1/2 PRECIZN-1 clinical study for the treatment of sickle cell disease.

Featured Stories

Before you consider Sangamo Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sangamo Therapeutics wasn't on the list.

While Sangamo Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.