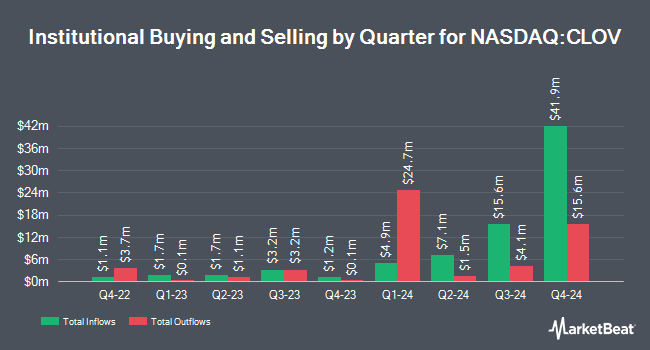

Schonfeld Strategic Advisors LLC acquired a new stake in Clover Health Investments, Corp. (NASDAQ:CLOV - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 590,571 shares of the company's stock, valued at approximately $1,860,000. Schonfeld Strategic Advisors LLC owned about 0.12% of Clover Health Investments at the end of the most recent reporting period.

A number of other institutional investors have also modified their holdings of the company. Vanguard Group Inc. raised its position in shares of Clover Health Investments by 2.0% in the fourth quarter. Vanguard Group Inc. now owns 19,585,213 shares of the company's stock valued at $61,693,000 after buying an additional 386,499 shares during the last quarter. Geode Capital Management LLC raised its position in shares of Clover Health Investments by 1.1% in the fourth quarter. Geode Capital Management LLC now owns 4,882,461 shares of the company's stock valued at $15,387,000 after buying an additional 53,760 shares during the last quarter. Marshall Wace LLP raised its position in shares of Clover Health Investments by 167.6% in the fourth quarter. Marshall Wace LLP now owns 3,769,765 shares of the company's stock valued at $11,875,000 after buying an additional 2,360,902 shares during the last quarter. Northern Trust Corp raised its position in shares of Clover Health Investments by 16.0% in the fourth quarter. Northern Trust Corp now owns 1,085,626 shares of the company's stock valued at $3,420,000 after buying an additional 149,714 shares during the last quarter. Finally, Teacher Retirement System of Texas acquired a new position in shares of Clover Health Investments in the fourth quarter valued at approximately $2,769,000. Institutional investors and hedge funds own 19.77% of the company's stock.

Insider Buying and Selling

In other news, Director Carladenise Armbrister Edwards sold 200,000 shares of the stock in a transaction on Friday, March 7th. The shares were sold at an average price of $3.61, for a total value of $722,000.00. Following the completion of the sale, the director now owns 273,227 shares of the company's stock, valued at $986,349.47. This represents a 42.26% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Brady Patrick Priest sold 75,000 shares of the stock in a transaction on Thursday, March 6th. The stock was sold at an average price of $3.68, for a total transaction of $276,000.00. Following the completion of the sale, the chief executive officer now directly owns 2,418,151 shares of the company's stock, valued at $8,898,795.68. The trade was a 3.01% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 327,500 shares of company stock valued at $1,197,500. Insiders own 22.28% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Canaccord Genuity Group boosted their price objective on shares of Clover Health Investments from $4.20 to $4.50 and gave the company a "buy" rating in a research report on Monday, March 3rd.

Check Out Our Latest Report on Clover Health Investments

Clover Health Investments Price Performance

CLOV stock traded down $0.24 on Friday, hitting $3.51. 7,646,927 shares of the company were exchanged, compared to its average volume of 6,802,677. Clover Health Investments, Corp. has a twelve month low of $0.82 and a twelve month high of $4.87. The business's fifty day moving average is $3.57 and its two-hundred day moving average is $3.71. The stock has a market capitalization of $1.79 billion, a price-to-earnings ratio of -17.55 and a beta of 1.99.

Clover Health Investments (NASDAQ:CLOV - Get Free Report) last issued its quarterly earnings results on Tuesday, May 6th. The company reported $0.05 EPS for the quarter, topping the consensus estimate of ($0.07) by $0.12. Clover Health Investments had a negative net margin of 5.92% and a negative return on equity of 25.46%. The firm had revenue of $462.33 million during the quarter, compared to analyst estimates of $466.93 million. Equities research analysts expect that Clover Health Investments, Corp. will post -0.12 earnings per share for the current year.

About Clover Health Investments

(

Free Report)

Clover Health Investments, Corp. provides medicare advantage plans in the United States. It operates through two segments: Insurance and Non-Insurance. It also offers Clover Assistant, a cloud-based software platform, that enables physicians to detect, identify, and manage chronic diseases earlier; and access to data-driven and personalized insights for the patients they treat.

Featured Stories

Before you consider Clover Health Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clover Health Investments wasn't on the list.

While Clover Health Investments currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.