Canadian National Railway (TSE:CNR - Get Free Report) NYSE: CNI had its price objective boosted by investment analysts at Scotiabank from C$160.00 to C$165.00 in a report issued on Friday,BayStreet.CA reports. The firm currently has an "outperform" rating on the stock. Scotiabank's target price would indicate a potential upside of 15.26% from the company's current price.

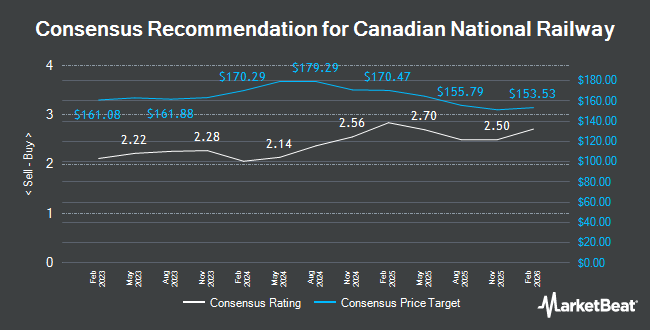

A number of other analysts have also recently commented on CNR. BMO Capital Markets cut their price objective on Canadian National Railway from C$175.00 to C$168.00 and set an "outperform" rating for the company in a research report on Friday, May 2nd. Susquehanna upgraded Canadian National Railway from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, May 6th. UBS Group boosted their price objective on Canadian National Railway from C$172.00 to C$174.00 and gave the company a "buy" rating in a research report on Friday, May 2nd. ATB Capital cut their price objective on Canadian National Railway from C$159.00 to C$156.00 and set a "sector perform" rating for the company in a research report on Friday, May 2nd. Finally, CIBC boosted their price target on Canadian National Railway from C$146.00 to C$155.00 in a research report on Thursday, May 22nd. One research analyst has rated the stock with a sell rating, six have issued a hold rating, nine have issued a buy rating and five have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of C$159.79.

Check Out Our Latest Analysis on CNR

Canadian National Railway Stock Performance

TSE:CNR traded down C$0.59 during trading hours on Friday, reaching C$143.16. The company had a trading volume of 1,755,474 shares, compared to its average volume of 1,353,192. Canadian National Railway has a 1-year low of C$130.02 and a 1-year high of C$172.36. The firm has a market cap of C$89.69 billion, a PE ratio of 15.48, a price-to-earnings-growth ratio of 3.38 and a beta of 0.65. The business's 50 day moving average price is C$140.55 and its 200-day moving average price is C$144.54. The company has a debt-to-equity ratio of 107.59, a current ratio of 0.64 and a quick ratio of 0.58.

Insider Activity

In other news, Director Shauneen Elizabeth Bruder bought 645 shares of the firm's stock in a transaction that occurred on Wednesday, March 26th. The shares were purchased at an average price of C$141.56 per share, with a total value of C$91,308.14. Also, Director Susan C. Jones bought 1,461 shares of the firm's stock in a transaction that occurred on Tuesday, May 6th. The shares were purchased at an average cost of C$136.62 per share, for a total transaction of C$199,600.80. Corporate insiders own 2.64% of the company's stock.

About Canadian National Railway

(

Get Free Report)

Canadian National's railway spans Canada from coast to coast and extends through Chicago to the Gulf of Mexico. In 2019, CN delivered almost 6 million carloads over its 19,600 miles of track. CN generated roughly CAD 14 billion in total revenue by hauling intermodal containers (25% of consolidated revenue), petroleum and chemicals (21%), grain and fertilizers (16%), forest products (12%), metals and mining (11%), automotive shipments (6%), and coal (4%).

Read More

Before you consider Canadian National Railway, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian National Railway wasn't on the list.

While Canadian National Railway currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.