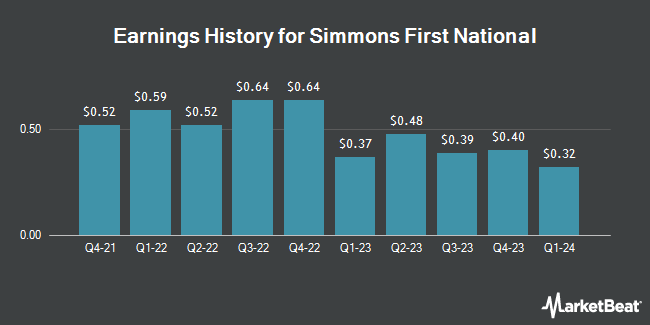

Simmons First National (NASDAQ:SFNC - Get Free Report) released its quarterly earnings data on Wednesday. The bank reported $0.26 earnings per share for the quarter, missing the consensus estimate of $0.36 by ($0.10), Zacks reports. Simmons First National had a net margin of 10.46% and a return on equity of 5.10%. The firm had revenue of $209.58 million during the quarter, compared to the consensus estimate of $209.00 million. During the same quarter in the previous year, the firm earned $0.32 earnings per share.

Simmons First National Stock Performance

NASDAQ:SFNC traded up $0.02 during trading hours on Monday, hitting $17.41. 802,219 shares of the company were exchanged, compared to its average volume of 603,549. The company's 50 day moving average price is $20.28 and its 200-day moving average price is $22.15. The stock has a market capitalization of $2.19 billion, a price-to-earnings ratio of 14.39 and a beta of 0.82. Simmons First National has a 52-week low of $16.03 and a 52-week high of $25.95. The company has a debt-to-equity ratio of 0.32, a current ratio of 0.79 and a quick ratio of 0.79.

Simmons First National Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, April 1st. Stockholders of record on Friday, March 14th were issued a dividend of $0.2125 per share. The ex-dividend date of this dividend was Friday, March 14th. This represents a $0.85 annualized dividend and a dividend yield of 4.88%. This is an increase from Simmons First National's previous quarterly dividend of $0.21. Simmons First National's dividend payout ratio is 73.28%.

Analyst Ratings Changes

Several equities analysts recently issued reports on the stock. Keefe, Bruyette & Woods cut their price objective on shares of Simmons First National from $23.00 to $21.00 and set a "market perform" rating on the stock in a report on Monday. Piper Sandler upgraded Simmons First National from an "underweight" rating to a "neutral" rating and upped their price objective for the stock from $20.00 to $21.00 in a research note on Monday. Finally, Stephens reduced their target price on shares of Simmons First National from $27.00 to $25.00 and set an "overweight" rating for the company in a report on Monday.

View Our Latest Stock Report on Simmons First National

Simmons First National Company Profile

(

Get Free Report)

Simmons First National Corporation operates as the holding company for Simmons Bank that provides banking and other financial products and services to individuals and businesses. The company offers checking, savings, and time deposits; consumer, real estate, and commercial loans; agricultural finance, equipment, and small business administration lending; trust and fiduciary services; credit cards; investment management products; treasury management; insurance products; and securities and investment services.

Featured Stories

Before you consider Simmons First National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simmons First National wasn't on the list.

While Simmons First National currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.