SkyWest (NASDAQ:SKYW - Get Free Report) is anticipated to issue its Q1 2025 quarterly earnings data after the market closes on Thursday, April 24th. Analysts expect SkyWest to post earnings of $2.01 per share and revenue of $946.13 million for the quarter.

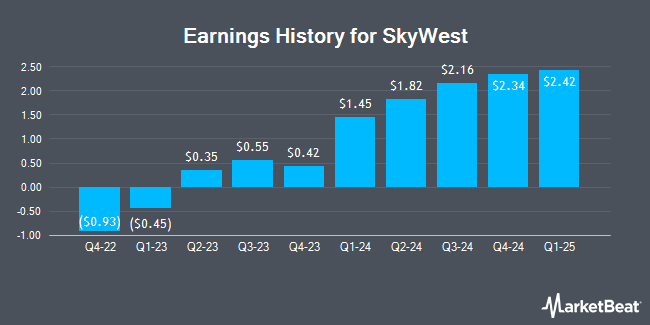

SkyWest (NASDAQ:SKYW - Get Free Report) last announced its quarterly earnings data on Thursday, January 30th. The transportation company reported $2.34 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.75 by $0.59. SkyWest had a return on equity of 14.17% and a net margin of 9.15%. During the same quarter in the previous year, the business earned $0.42 earnings per share. On average, analysts expect SkyWest to post $9 EPS for the current fiscal year and $10 EPS for the next fiscal year.

SkyWest Stock Down 2.3 %

Shares of NASDAQ:SKYW traded down $1.93 on Monday, hitting $83.45. 296,170 shares of the company traded hands, compared to its average volume of 398,869. The stock has a 50 day simple moving average of $90.84 and a 200-day simple moving average of $100.89. The company has a quick ratio of 0.68, a current ratio of 0.78 and a debt-to-equity ratio of 0.89. The company has a market cap of $3.39 billion, a PE ratio of 10.74 and a beta of 1.83. SkyWest has a 52 week low of $64.61 and a 52 week high of $135.57.

Wall Street Analyst Weigh In

Several brokerages have issued reports on SKYW. StockNews.com cut shares of SkyWest from a "buy" rating to a "hold" rating in a report on Saturday, April 12th. The Goldman Sachs Group upgraded shares of SkyWest from a "neutral" rating to a "buy" rating and decreased their price objective for the stock from $119.00 to $117.00 in a report on Tuesday, April 8th. Finally, Raymond James reduced their target price on SkyWest from $130.00 to $125.00 and set an "outperform" rating for the company in a report on Wednesday, April 2nd.

View Our Latest Analysis on SkyWest

Insiders Place Their Bets

In other news, CFO Robert J. Simmons sold 6,000 shares of the company's stock in a transaction dated Monday, February 10th. The shares were sold at an average price of $113.57, for a total transaction of $681,420.00. Following the completion of the sale, the chief financial officer now owns 175,067 shares of the company's stock, valued at $19,882,359.19. This represents a 3.31 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, VP Greg Wooley sold 14,545 shares of the firm's stock in a transaction that occurred on Tuesday, February 18th. The stock was sold at an average price of $105.73, for a total transaction of $1,537,842.85. Following the completion of the transaction, the vice president now directly owns 68,737 shares in the company, valued at approximately $7,267,563.01. The trade was a 17.46 % decrease in their position. The disclosure for this sale can be found here. 2.00% of the stock is currently owned by insiders.

SkyWest Company Profile

(

Get Free Report)

SkyWest, Inc is the holding company for two scheduled passenger airline operations and an aircraft leasing company. SkyWest's airline companies provide commercial air service in cities throughout North America with nearly 3,000 daily flights carrying more than 53 million passengers annually. SkyWest Airlines operates through partnerships with United Airlines, Delta Air Lines, American Airlines and Alaska Airlines.

Featured Stories

Before you consider SkyWest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SkyWest wasn't on the list.

While SkyWest currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.