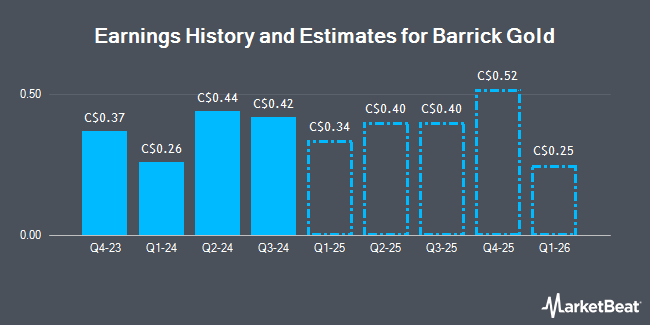

Barrick Gold Co. (TSE:ABX - Free Report) NYSE: ABX - Analysts at Stifel Canada issued their Q2 2025 earnings estimates for Barrick Gold in a research report issued on Monday, June 16th. Stifel Canada analyst R. Profiti anticipates that the basic materials company will post earnings per share of $0.69 for the quarter. Stifel Canada currently has a "Strong-Buy" rating on the stock. The consensus estimate for Barrick Gold's current full-year earnings is $2.24 per share. Stifel Canada also issued estimates for Barrick Gold's Q3 2025 earnings at $0.70 EPS, Q4 2025 earnings at $0.74 EPS, Q1 2026 earnings at $0.74 EPS, Q2 2026 earnings at $0.73 EPS and FY2029 earnings at $4.12 EPS.

Several other research firms also recently weighed in on ABX. National Bank Financial raised shares of Barrick Gold to a "hold" rating in a research note on Friday, March 21st. UBS Group raised shares of Barrick Gold from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, March 5th. BMO Capital Markets upgraded shares of Barrick Gold to a "hold" rating in a research report on Tuesday, April 15th. Stifel Nicolaus raised their price objective on shares of Barrick Gold from C$34.00 to C$37.00 and gave the stock a "buy" rating in a research report on Monday, April 21st. Finally, Sanford C. Bernstein cut their price objective on shares of Barrick Gold from C$45.00 to C$43.00 and set an "outperform" rating for the company in a research report on Friday, May 2nd. Five analysts have rated the stock with a hold rating, five have assigned a buy rating and three have issued a strong buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of C$33.67.

View Our Latest Stock Report on ABX

Barrick Gold Price Performance

Shares of TSE:ABX traded up C$0.02 during midday trading on Wednesday, hitting C$28.79. The company's stock had a trading volume of 7,545,964 shares, compared to its average volume of 3,718,922. The business's 50 day simple moving average is C$26.96 and its 200 day simple moving average is C$25.57. The company has a debt-to-equity ratio of 19.83, a quick ratio of 2.62 and a current ratio of 2.65. The company has a market cap of C$34.99 billion, a P/E ratio of 21.68, a price-to-earnings-growth ratio of 2.34 and a beta of 0.48. Barrick Gold has a 12-month low of C$21.73 and a 12-month high of C$29.50.

Insider Buying and Selling at Barrick Gold

In other Barrick Gold news, Senior Officer Henri Louis Gonin sold 1,000 shares of Barrick Gold stock in a transaction dated Tuesday, March 25th. The shares were sold at an average price of C$27.72, for a total transaction of C$27,720.55. Company insiders own 0.60% of the company's stock.

About Barrick Gold

(

Get Free Report)

Barrick Gold Corp is one of the world's largest gold producers, operating mines in North America, South America, Australia, and Africa. The company segments consist of nine gold mines namely Carlin, Cortez, Turquoise Ridge, Pueblo Viejo, Loulo-Gounkoto, Kibali, Veladero, North Mara, and Bulyanhulu. It generates maximum revenue from the Carlin mine segment.

Featured Stories

Before you consider Barrick Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrick Gold wasn't on the list.

While Barrick Gold currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.